Debunking blue chips

Let's debunk another Big Lie of the NFT space.

"Invest in bluechips".

Anon, I'm here to tell you that there's no such thing, and if you try to follow that occasionally well-intentioned bit of advice...

YOU WILL GET REKT.

Let's look at some fucken data.

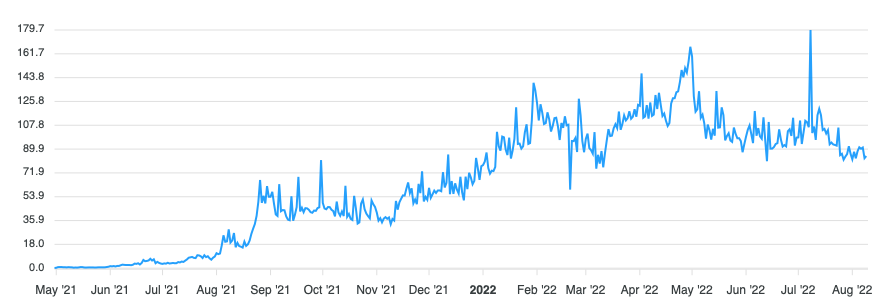

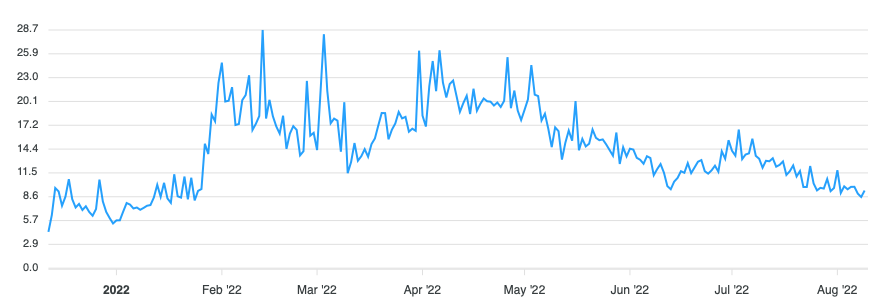

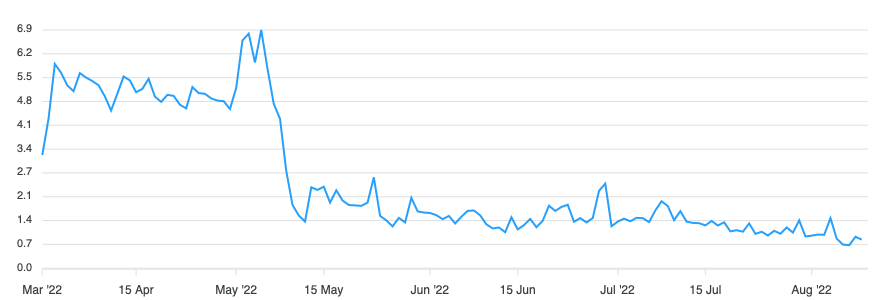

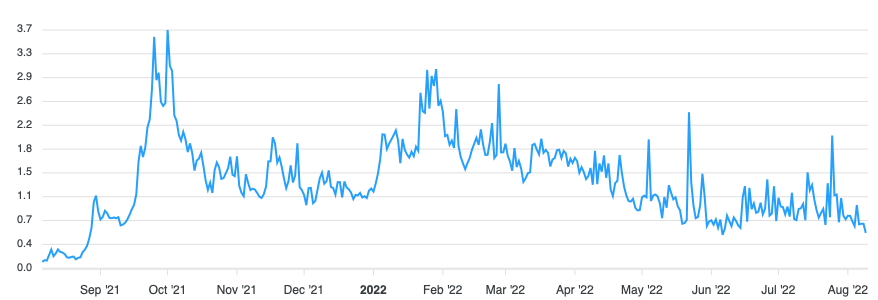

I'm gonna start with one of the grandaddies of bluechips - Cyberkongz.

Back in the Great Bull of 2021, the Kongz ruled over all. They traded for over 100, sometimes 200 Eth.

Back in those heady days, ppl already talked about Bluechips, and the Genesis Kongz were definitely one.

What happened since? Genesis Kongz are now trading around 15-20 eth. A respectable price, certainly, but a 90+% drop from their heyday.

If you parked your hard earned money in Kongz during the 2021 bull, either you got out quick or you got rekt.

I'll intersperse the data in this thread with notes... because if I put them all at the end no one will read them. And if they all go at the beginning, ppl might miss out on the data.

First note is:

Buying into a strong blue-chip is no guarantee of safety.

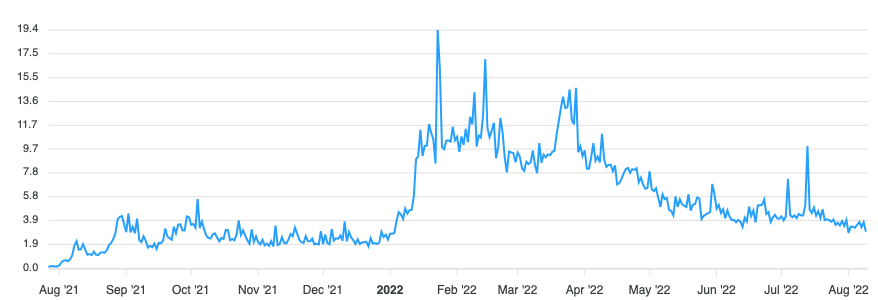

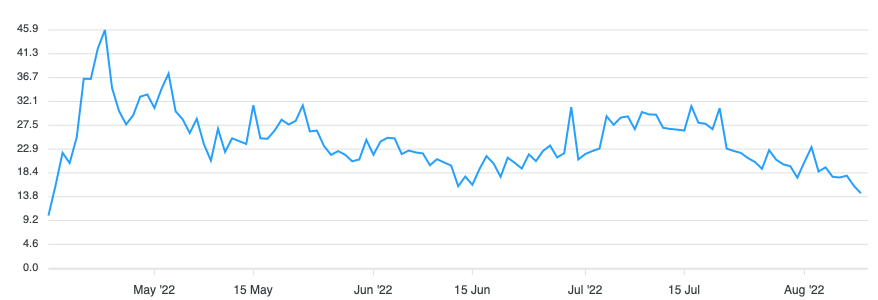

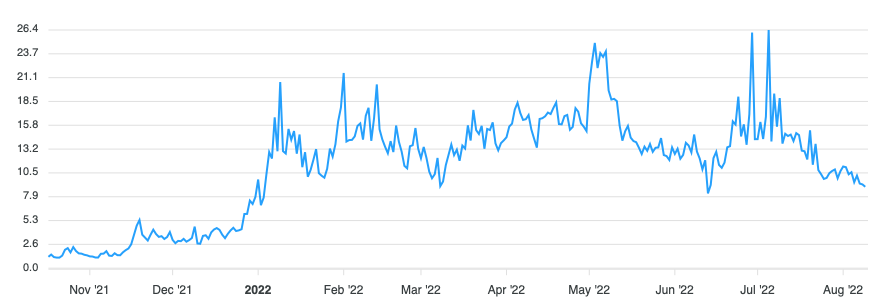

Let's look at another undoubtable bluechip. Cool Cats. They were among the heroes of 2021, reaching peaks above 20 Eth. Even in 2022, around the Cool Pets launch, they were in the low 10s of Eth.

Unique style, captured people's imagination. And many of them are actually blue!

They're currently trading around 2-3 Eth. That's an 80-90% decline depending on when you bought in.

If you bought a single cool cat when they were popular, you might have lost between 8 and 18 Eth on that.

The cool pets didn't do much better, btw - which is a piece of evidence against buying into sub-collections of popular bluechips as a way to "get in cheaper". Yeah, sure, if you bought one of those, you only lost about 3 Eth, I suppose.

Another note to say: yes of course it is possible to have made money on these projects. If you bought them low and sold them high.

But that's true for everything, and not what people mean when they suggest buying blue-chips as a safe place to park or invest your money.

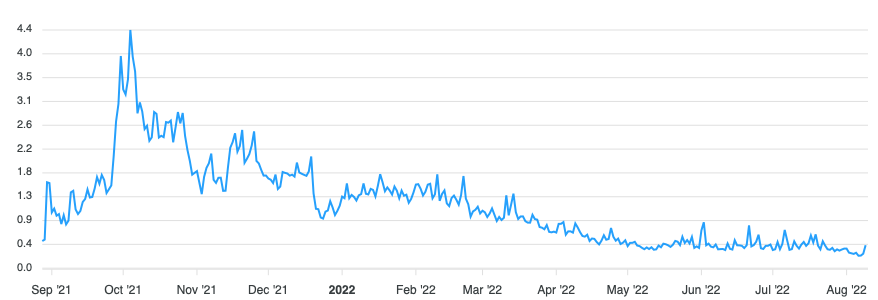

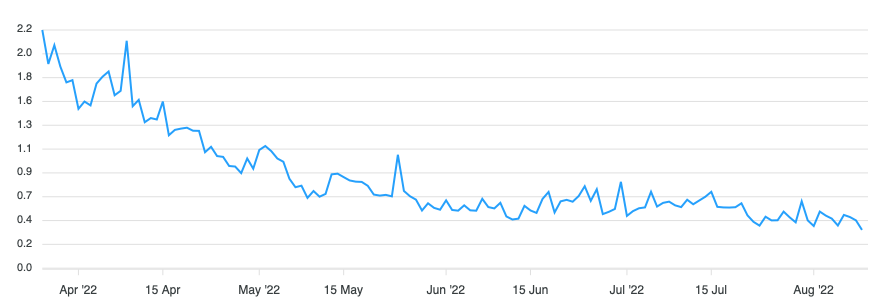

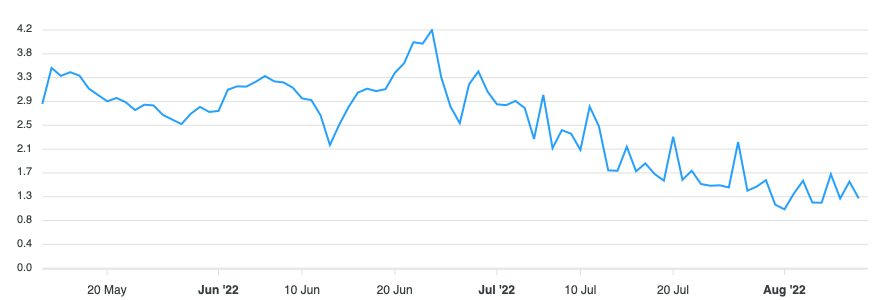

Back in Sept 21, my wife wanted to invest 3 Eth in NFTS. I remember asking on Discord, and was recommended buying Creature World. Shaq was involved, it was a clear bluechip, and it had been testing and supporting the 2 Eth level for a while. Primed for growth at any moment.

Needless to say, that's not quite what happened. From highs above 3E, CW has descended to the depths, occasionally touching 0.3E. Up to 90% decline here too, depending on where you bought. 85% if you bought at 2E. Thankfully, back in Oct, I passed.

The Big Lie of Blue Chips is the idea that there is any such thing. Blue Chips, in the stock market, retain value, rebound when they go down, and only very rarely have catastrophic failures à la Enron/Lehman/Bear Stearns. Even in stocks this can happen, but it's really uncommon.

In the NFT space, it's extremely common. The rarity is to find a project that has not followed this common story path: the rise, the euphoria, the blue chip label, and then the long slow bleed to zero.

"Blue chip" is a toxic term.

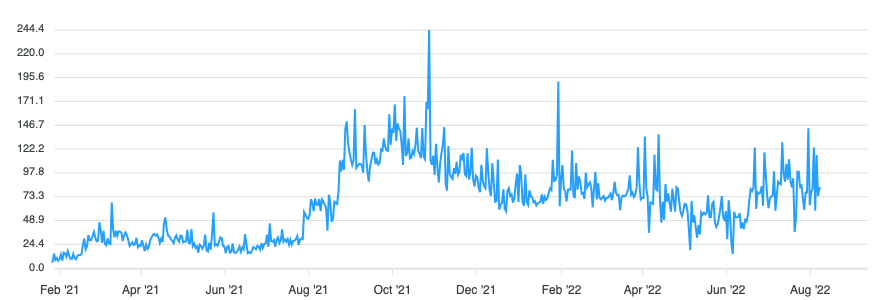

But Daniel, what about, say, Crypto Punks?

Ok, let's look at CP. In the summer 2021, when they ruled all, they easily traded above 100 Eth, sometimes above 150. Granted, they've had a bit of a comeback lately, but they're still around half that price.

And before this come back they had descended from those lofty heights down to sub 50 Eth at one point.

It's one thing to lose 50% on your portfolio of 10 NFTs that cost 0.1 each. No one likes to lose a thousand bucks or thereabouts.

50+% down on an NFT that cost you more than 100 Eth is 50 Eth down. On a single trade.

And that's not even counting the dollar loss from Eth going down the drain. Even in Eth terms, the risk level of bluechips is stomach-churning.

And ppl say those are the safe projects!

So far, I've only shown failure stories. Are there some success stories? The first one on anyone's mind is BAYC ofc.

Depending on when you bought your ape, you may well be up on it. They're currently in the 80s. They traded well above 100 for a while.

So BAYC is not as bad a loss as some of the others. Still, if you timed your purchase wrong by, say, buying the project when everyone was super-bullish on them, you're now a few tens of Eth down.

And that's the most successful project in the NFT space!

You may say, well, yes, of course, NFTs are volatile, just like crypto is volatile. After all, BTC and Eth are also down some ungodly %.

But there's a few big differences. First of all, smart people don't advise each other to park their cash into BTC "because it's safe".

The argument is more that BTC has lasted a decade already, is likely to last, so even though it's violently volatile, it'll likely continue to go up over time, even if you're unlucky enough to buy a peak. So if you don't need the money, it might be worth putting it there.

Otoh, ppl in the NFT space are actively advised to "park" their money into "bluechips" as if that was not the most insanely risky place to put it.

Folks, if you've got some profits you want to keep safe, park them in a basket of fiat currencies. Probably mostly USD.

Let's go through a few more. CloneX - up in the high tens low twenties for some time, now below 10. 50% loss.

World of Women, a fine, reputable project with a solid pedigree. Down from around 10 to below 4. 60%

WoW Galaxies, the spinoff? Down from 1.5-2 to below 0.4 - 80% loss.

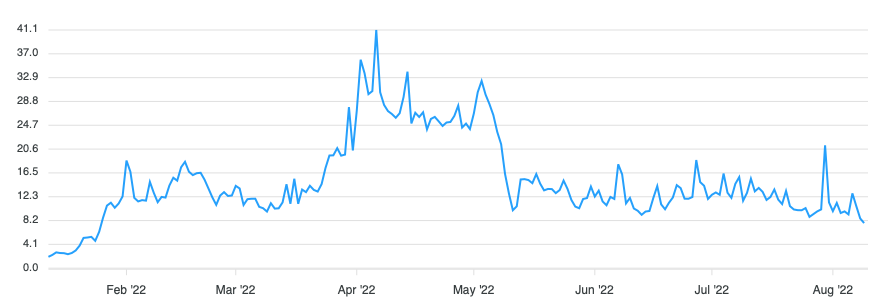

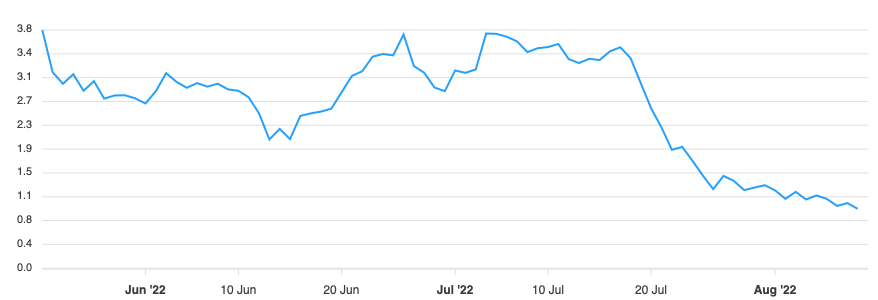

Azuki, once a contender for the crown of the NFT space before they shot themselves in the face.

If you bought when they looked strong, around 25E, you're now down to 7-8 - 70% loss.

Their Beanz? 4.5E or so down to 0.7ish. 85%.

These last few also make the point that side collections don't avoid this problem. When the parent collection starts sliding, the child collections also go down the drain with them, but worse.

So child collections of "bluechips" are riskier.

Why? Because they get a double-whammy of bad luck. First, they're instantly overpriced because of the link to a "bluechip". Secondly, their fate is not even linked to their own achievements, but to the impossible expectations on the parent bluechip.

Guaranteed downside.

Hey wait a minute, there must be some more exceptions. Ok so moonbirds is still hanging in there reasonably well, right? Well, if you call a drop from the high 20s to the high 10s "reasonably well", then alright.

They're doing better than most - in Eth terms.

Oddities hasn't fared so well though, perhaps represented an amplification of the gentle downslide that Moonbirds is experiencing. I'm no prophet, but I wouldn't be surprised if Oddities was just a future graph of Moonbirds.

When an NFT project is designated as a bluechip, by definition it is at peak hype.

It can only go down from there.

So here's a new idea for y'all:

If ppl start calling one of your project a bluechip, take that as the strongest sell signal there is.

Btw, if you like these threads, there are many more like it on https://swombat.io . And if you want me to post more, you can help my dopamine levels by retweeting, liking, commenting. I'm like a hamster in a metacage, I post more when sugar water comes down the pipe.

❤️🙏

But Daniel, everything goes up and down, that's normal, it's the markets.

Yeah maybe. Perhaps there's just a market-wide downturn and CyberKongs will go back up to 200 Eth in the next bull, even though it didn't in the last one in January.

Somehow... I don't think so. Do you?

Whilst there might be a precious few projects that do get back up and even overtake their previous ATHs, how do you know which one it is?

Whatever the method, it's not by the fact that others are calling them "bluechips", that bit seems clear.

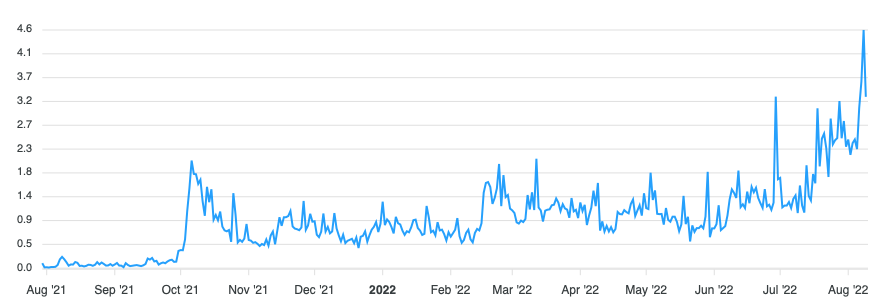

Let's have a few more top project charts... Invisible Friends... "the next bluechip" was surely a common epithet for this cool animated art that launched with a big bang. Down 60-80% or so.

What about when a youtube star launches a project? They can surely keep driving attention to it, that's their whole gig right? Tell that to JRNY holders, down from 3ish Eth to about 1.

What about projects which are really good at generating hype for themselves? I once described Lazy Lions as a next-level guerilla marketing swarm, and maybe they were, but a safe investment? They're back from 3E to where I first bought on Sept 1st 2021. But with Eth down bad.

Doodles is one which is not doing too awful depending on where you bought. If you didn't buy when they were looking really strong, you might be flat. Otherwise, could be down 50%ish.

If their Dooplicators are a leading indicator, though, beware.

MAYC is also doing alright, though it again really depends on when you put your money in there. You could be down up to 50% in Eth terms.

Are there exceptions, projects that are doing well? Sort of. For now. CryptoDickButts are having a great time. I wouldn't be surprised if ppl started calling them a bluechip soon. If you own any at that point, you know what my advice is!

Btw, my point is not that any of these projects are "bad". I make no comment on that matter.

The point of this thread is that they are not good places to "park your money", if you look at the data with clear eyes, and like to sleep at night. They are not safe or sure bets.

In my view, "bluechips", which are usually far more expensive, are not less risky, but are great ways to concentrate your risk/reward on fewer gambles. Because imho, at that point, that's what they are: gambling.

Bluechips are at the top of the hype curve. By the time they're seen as bluechips, they are 99% hype and maybe 1% value (often 0%). It's hard to tell.

Buy low, sell high, to make money.

Bluechips are, by defintion, "high".

Sell them, don't buy them!

As a final thought, I'm pretty sure that the only reason bluechip prices slide down so slowly is because it's impossible to short NFTs, and the supply is small enough to be cornered by whales, at least for a while. And the whole "diamond hands" meme virus.

If DeFi ever gets its grubby paws on NFTs and enables some form of short-selling to come in, I'm pretty sure most of those bubblechips will deflate faster than you can say "hype".

I think that'll be a good thing, personally. If you're holding bluechips that day, you won't agree.

So, TL;DR:

- Buying into a strong bluechip is no guarantee of safety.

- To make money on bluechips, like on everything else, you have to buy low and sell high (duh)

- If "bluechips" = "stable, secure places to stash your cash"... there are no NFT bluechips. None. Zilch.

- If you want to park your money somewhere safe, try USD!

- Spinoffs of bluechips do worse than the bluechips.

- If ppl start calling a project you hold a bluechip... sell.

- Bluechips are just more expensive, riskier, more thrilling gambles.

Next time someone tells you to buy a given project because it's a bluechip and is safe(r)... send them this thread. And give that purchase a miss.

Maybe it'll be the 1 out of 10 that goes up instead of down, but probably not.

gm & gl

Original Thread:

https://twitter.com/swombat/status/1557466468761190400?ref_src=twsrc%5Etfw