Most PFP projects are securities.

We, and the SEC/FCA, need to embrace this.

The sooner we do, the sooner we’ll be on our way to revolutionising startup fundraising in a way that will fund more innovation in every area of life than we’ve ever seen.

If you’ve been reading my threads (if not, check https://swombat.io ), you’ll know I regard many PFP projects as basically startups, and believe that NFTs will displace shares in the next 5 years.

NFTs can & should replace shares. But although they could replace them 1:1, they also enable much more creative ways of raising funding and sharing growth with early backers.

So I think a better way to put it is: NFTs should make share-based fundraising obsolete.

How? Why?

👇

— Daniel Tenner (@swombat) February 5, 2022

At the same time, most of the PFP space is operating in this twilight land where everyone has their fingers planted in their ears and is yelling, at the top of their voice, “We’re not a security! We’re not a security!”

This is utter bullshit, and harmful.

It’s bullshit because PFP projects are obviously securities. The only way to pretend they’re not is to ignore everything that makes them good, and focus on the degen/gambler aspects, which imho make them worse than unregistered securities – instead, they’re unregistered lotteries.

Believe it or not, promoting expensive lotteries that are open to the public and promise fantastic prizes is an activity that’s typically regulated by the relevant gambling authorities. In most parts of the world those regulations are just as tough as the SEC.

But since everyone (including Mr Gensler) keeps fudding about the SEC, rather than the Gaming Commission, PFP project founders have been trying to evade SEC regulations and end up focusing much more on “we’re going to the moon”, aka “you’ll make a lot of $$$” than “we’re a solid business!”.

I’m not a lawyer, but I doubt the Gaming Commission will take any more kindly to all this unlicensed ponzi gambling than the SEC would, once they wake up to it.

And tbh, if all the PFP space turns into is an endless series of ponzi lotteries, what’s the point of it?

The current SEC is being Dr Evil levels of unhelpful. Perhaps that’s why.

Even so, I think it would be better for PFP projects to embrace the fact they are securities, and take the steps they need to take to protect their founders, and operate as what they are: securities.

Then the PFP space can develop healthily as a superpowered alternative to angel seed fundraising (and maybe even displace VCs) instead of constantly jumping from one foot to the other trying to pretend to not be what it obviously is.

How obvious is it?

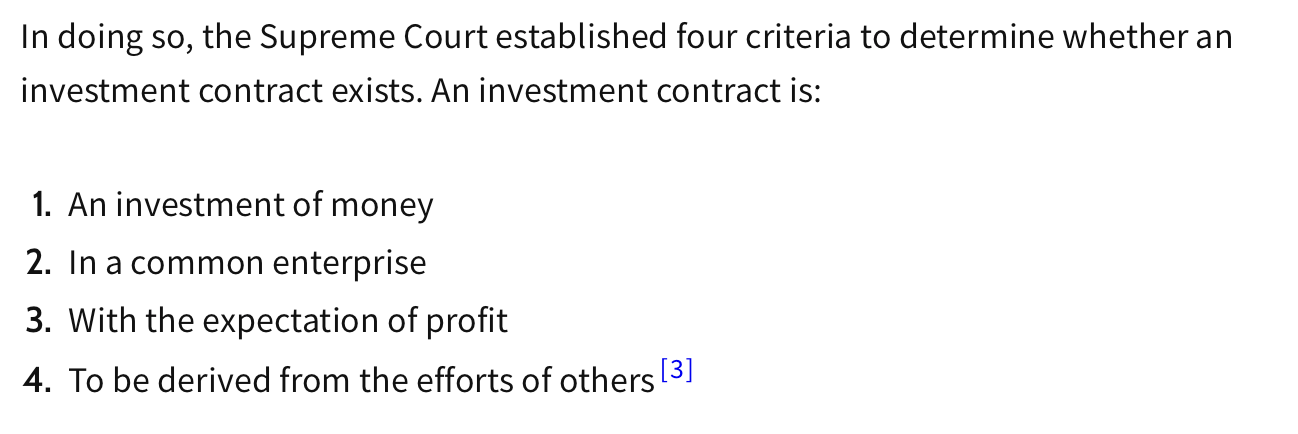

The idea that most of those PFP projects doesn’t trigger the Howey test is ludicrous.

Have a look for yourself:

PFP projects are obviously common enterprises. Except for free mints (but even those change once on secondary), they are investments of money. The vast majority involve an expectation of profit that will come from the efforts of others.

Some may try to make an effort to claim that “well, we can’t control how others view our projects, but that’s not how we’re operating it”. Again IANAL but I doubt that will pass muster before the SEC or a judge.

Others don’t even bother:

“Stake your Pungent Porcupine to earn Quills that you can use to make baby Porcupines that you can then sell… etc”

Those are obviously all securities to anyone who’s not guilty of highly motivated reasoning.

People who think that somehow by blindfolding themselves and pretending they don’t know, they will be safe from SEC/FCA/etc pursuing them for selling unregistered securities have a very poor understanding of the law and have never spoken to a lawyer, I guess.

The law can come and get you long after your offence was committed. You may think that there are too many ppl doing this stuff for you to stand out, but that’s really no protection. Esp. if you ever have any success, attention will fall on you. And you do want success, right?

I have spoken to lawyers. 6m ago I looked into starting a venture fund, funded by an NFT sale, and guess what: they said to incorporate both the fundraising & the fund in the Cayman Islands to avoid personal liability. Didn’t even charge me for that advice. It’s that obvious.

Some in the PFP space have taken the time to speak to lawyers. I had a long chat with @YounisJoseph of @EnigmaECONOMY (I was, and am still planning, to do a long-delayed review thread Enigma; disclosure) and they have their t’s crossed and i’s dotted.

Founders who don’t take the time to speak to lawyers at all are deluded or naive. Founders who do speak to lawyers, but then vouch to never do anything that would make the project look like a security are, imho, taking the lazy route – and probably will screw it up anyway.

I won’t go into the detail of my conversation with @YounisJoseph here, but suffice to say, he was very aware of the difficulties the SEC might pose and had plans in place, with legal support, to ensure Enigma can operate as what it is: a startup funded by NFTs.

To quote Joseph: “The only [definitive] strategy is structuring yourself with the capacity to comply when necessary.”

I’d suggest that’s also true for the other hundreds or maybe thousands of legitimate PFP projects that are currently pretending to be something they’re not.

Ultimately, at some point, all those projects will either be shut down as illegal securities, or they will do the work to become legal (or they will just go bankrupt).

I don’t see any other way. And that applies to everything from BAYC to Kevin mfers derivs.

Quoting a lawyer friend of mine: it’s not a matter of if they check you out, it’s a matter of when.

Eventually, your dumb project you did for fun is gonna get looked at by a regulator.

If it looks like a security to them, they’ll pounce, whatever you think it is.

How will the SEC and FCA behave in all this?

I don’t know.

They could be real dicks about it, as they are being now, and make it ever harder to operate a project in the US/UK.

That won’t solve their problem at all, it’ll just move it elsewhere.

As my lawyers advised: just incorporate the business in a jurisdiction that’s more crypto friendly.

So if the SEC/FCA go hard against the PFP projects and act all unreasonable, they’ll just score a spectacular own goal and push all that juicy innovation offshore.

If some evolution of PFP projects is the future of Securities, but all those projects are incorporated in Bermuda instead of the US… the US loses out. So hopefully the SEC comes to their senses and regulates this in a sensible rather than inane manner.

So here’s my advice to founders. And this can apply to founders of existing projects as well as new ones. You can always take steps to improve your legal situation even after the fact, and trying to improve your compliance usually looks better than pretending it doesn’t exist.

- Find a lawyer who’s aware of these kinds of issues and budget for some of their time

- Figure out how to incorporate a limited liability vehicle for your project (only fools operate businesses without limited liability protections!)

- Consider that eventually the SEC or equivalent will come knocking and take steps to be prepared for this

- Embracing the fact that you are likely to be considered a security eventually, make your security a damn good one that’s worth keeping around

That last point is important imho. If the SEC comes knocking on BAYC’s door, they’re likely to observe that BAYC is a hugely successful and impactful project which is well past the stage of being considered some kind of scammy ponzi.

I imagine they’ll regard it differently than some ponzi p2e “game” that just shuffles money around like a lottery (though tbf they might just pass that garbage to the gaming commission).

And this is the key point to take away from this thread imho: the harm in the current meta.

By desperately trying to make their projects not look like PFPs, a lot of founders are, imho, avoiding building long term viable and worthwhile projects.

That’s a very unfortunate side effect of the current regulations regime.

I am not a lawyer. Before you start any kind of PFP project please do speak to one – and a decent one. Most good ones will have an initial conversation for free and then charge for the actual work. Startup-friendly ones often delay the bill till after the funds are in.

Don’t get your legal advice from ppl on Discord. Or from your mates who have thought about PFP projects. Or from someone at a bbq.

Contact an actual legal firm that understand crypto and speak to them about how to protect yourself from GOING TO JAIL or GETTING FINED A LOT OF $$.

Please do that bit of work to figure out:

= how to build a good project that will eventually be compliant =

rather than

how to build a project that tries so hard not to be a security that it fails to actually be a good project and just becomes another degen trap.

Thanks 🙂 Have a lovely day.

gm & gl

PS: IANAL. I am not a lawyer.

Original Thread:

Most PFP projects are securities.

We, and the SEC/FCA, need to embrace this.

The sooner we do, the sooner we'll be on our way to revolutionising startup fundraising in a way that will fund more innovation in every area of life than we've ever seen.

— Daniel Tenner (@swombat) March 8, 2022