NFT Project Utility and Sustainability

Most NFT projects have by now cottoned on that they need to give "utility".

But most are getting this wrong and doing it in an unsustainable way that can't work.

Wanna be able to tell if the project you're looking at is sustainable? Read on.

Fundamentally, NFT projects are not all that different from startup companies or other businesses. Many think they are "art" but they're not. They have investors looking for a return. They have a team working to deliver on a plan. They have a vision.

They're startups.

All startups fundamentally have to abide by a simple rule: you can't just create money out of nowhere. The money has to come from somewhere.

This applies even in crypto, unless your entire ecosystem has no interest in ever converting to/from other valued currencies.

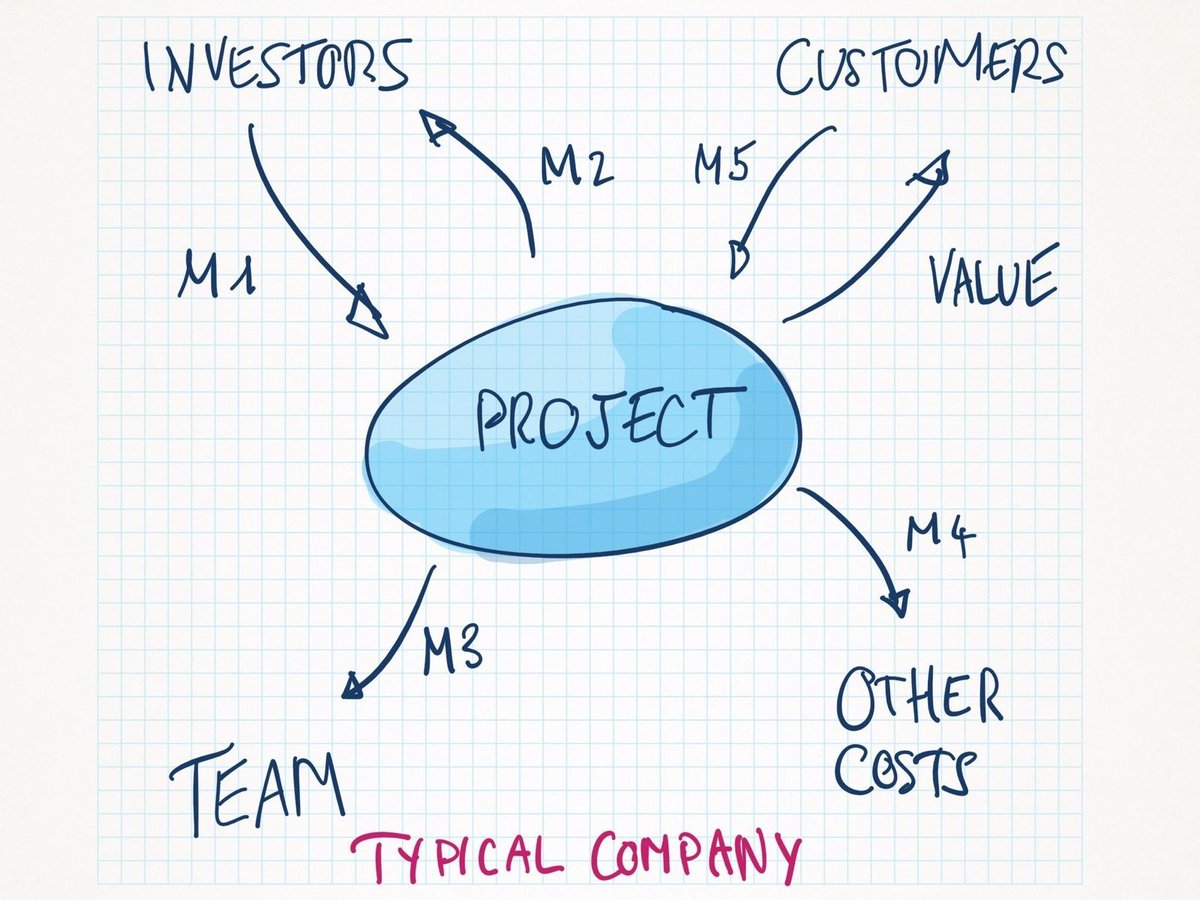

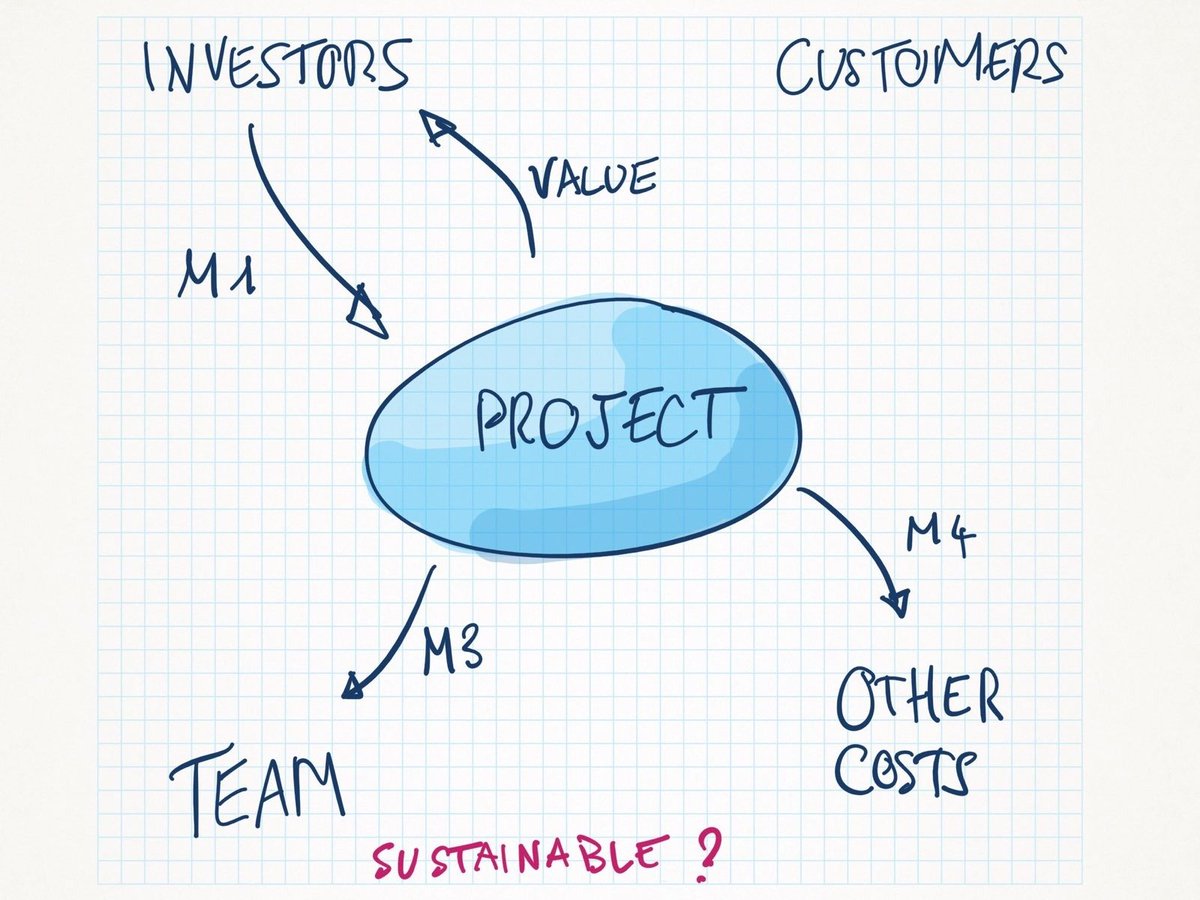

This means that NFT projects will have to abide by simple arithmetic laws. They're easy to see if you look at the following simple diagram, which represents a typical business.

In your classic startup, investors put some money in (M1), some of it goes to pay for random costs (M4), and to pay the team to work on the project (M3). Eventually, Value is created, which customers are willing to pay M5 for. Then investors get their money back as M2.

Over the lifetime of the project, it is impossible to break the following equation:

M1 + M5 = M2 + M3 + M4.

Money in = Money out.

You can't create money out of thin air. You can create value, and then get people to pay you for that value. That's what most businesses do.

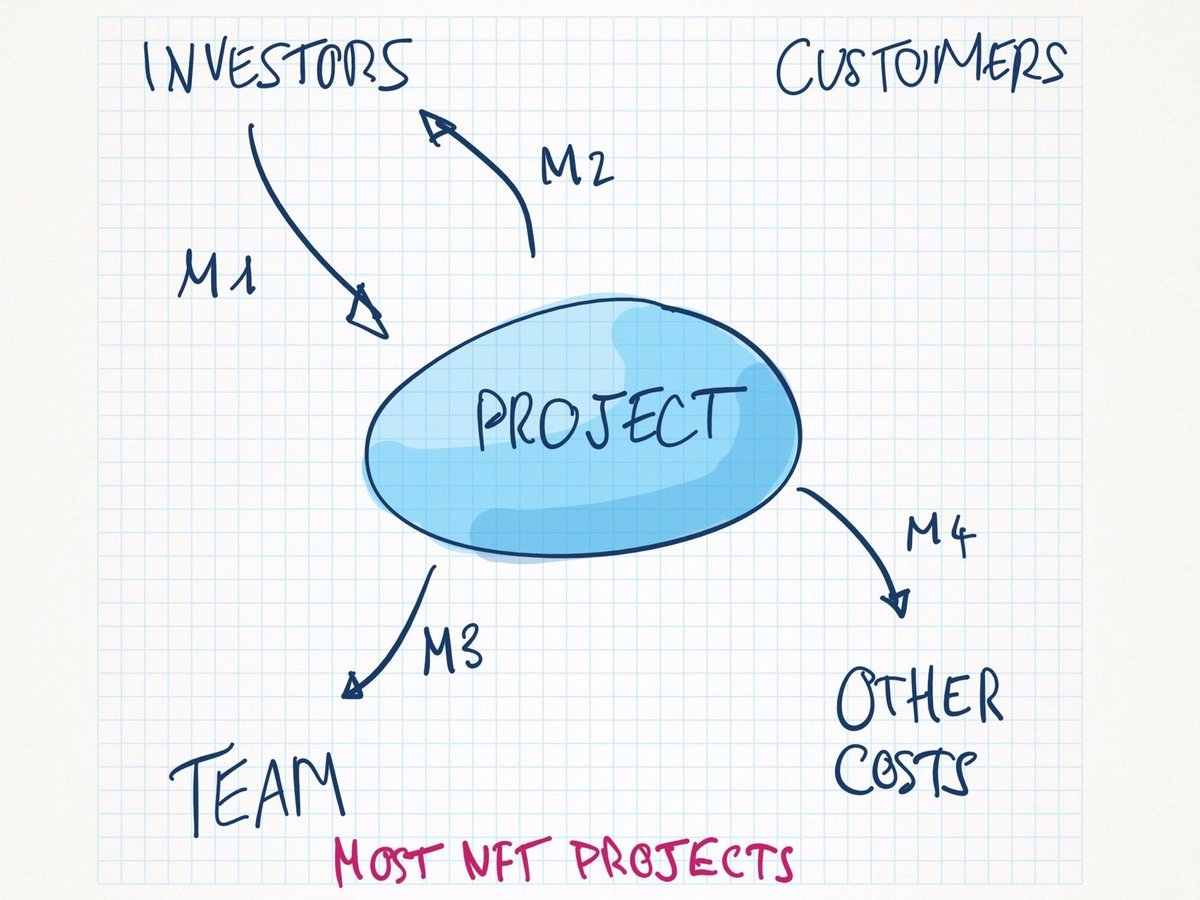

NFT Projects are in a slightly different situation though. Generally, and so far that holds for every project I've seen (please point me to ones that are different if you know one!) - NFT projects do not have customers.

That means M5 is always 0.

But the equation still holds:

M1 = M2 + M3 + M4

You can't create money out of thin air.

Over the lifetime of the project that equation holds, but over shorter timescales it is possible to appear to have broken the equation.

The most common way this happens is when investors can keep investing any time, rather than just at the beginning.

Can you see where this is going?

If there are enough later investors, or if they pay high enough prices, then you can pay off earlier investors with the money raised from later investors.

That works, for a while. But it is inherently unsustainable, because in the long term the equation will hold.

Also there's a name for a scheme where you pay outsized returns to earlier investors from the money paid by later investors. If you're in the NFT space you know that five-letter word and it often gets thrown about without much thought.

At this point it may be worth a short diversion to point out that it is quite possible that Charles Ponzi was an honest entrepreneur. He had an arbitrage scheme to do with postage stamps that he thought would genuinely make a lot of money.

He might have just got caught up in the excitement of all these investors throwing their money at him, and at some point forgot to actually execute the scheme, and started paying off earlier investors with money from the later investors.

He didn't have the time or the inclination or the wisdom to stick his head out and realise that what he was doing was not sustainable.

I suspect that, rather than outright fraud, is the case with many - sorry, most, NFT projects out at the moment.

Most of them.

There is a way out of this, where a project can be sustainable without having customers. And most projects are aware of this and so everyone is always talking about project "utility".

But they're getting it wrong.

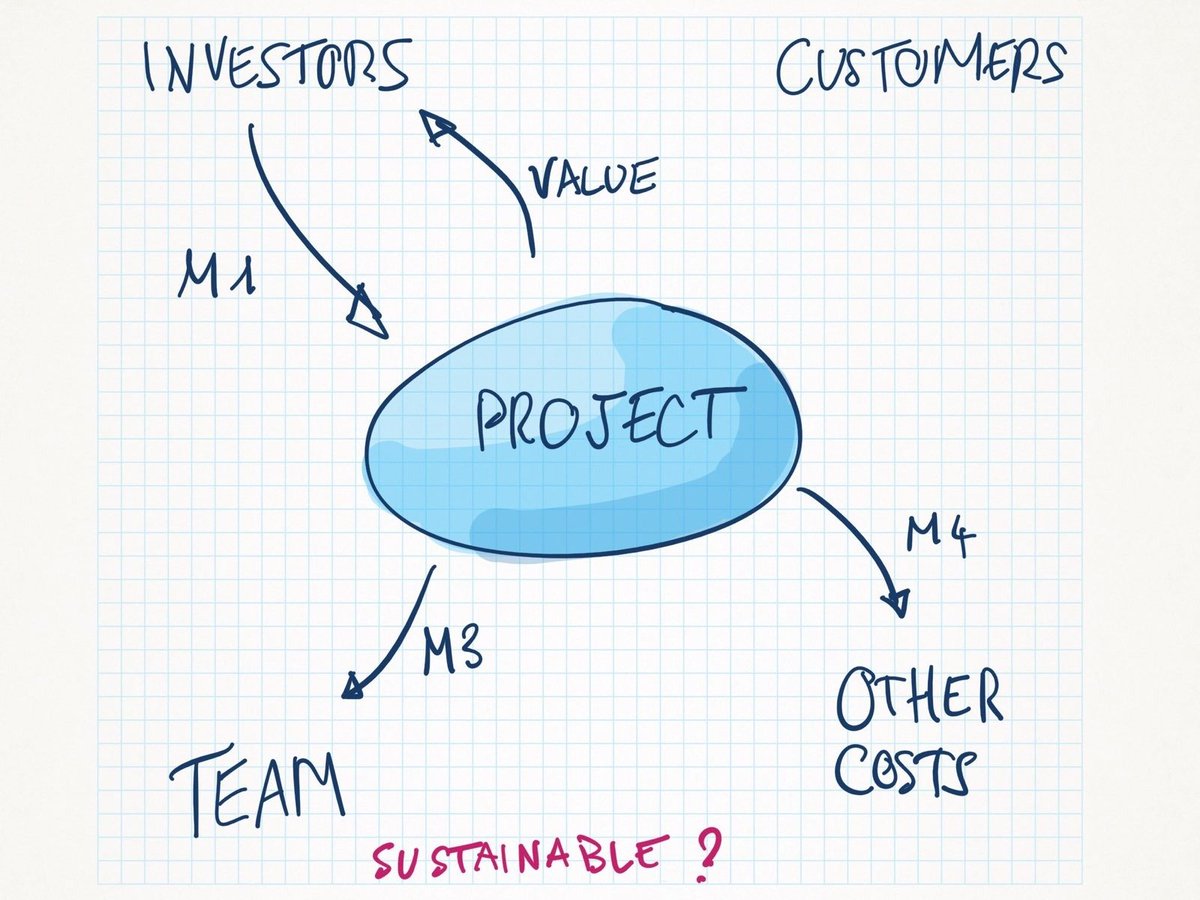

Here is the pattern for a sustainable project without customers. Investors pay for a project that delivers them value. In a way, investors *are* the customers. It's like a crowdfunding on steroids model - if the value is sufficient to justify the investment.

However, where this is going very wrong is that because most "investors" in the NFT space are really just looking to "make money quick", NFT projects have zoomed in on "well, we'll give you money" as a solution to utility.

But if the value is financial, whether directly or indirectly, then we're back to the second picture, and back to that inexorable equation.

M1 = M2 + M3 + M4.

There is no way for these projects to pay investors more than they put in, other than the time-honoured way of fleecing later investors to pay earlier ones, which is, for good reasons, illegal, because it is unsustainable and someone is always left holding the bag.

That doesn't mean you can't make money from those Ponzi schemes. If you're lucky to catch them at the right time, sure, you might even make a small fortune. But be aware that you're basically participating in an unsustainable scam, and fleecing fools.

Any project where "Value", in this graph, is basically money... is not sustainable.

Whenever "utility" is explained, think: "does this basically translate to money from the project?"

If so, it's not sustainable.

What if the money is coming from other projects? Collaborations? Free mint slots? Whitelist slots?

I'm sorry, but it's still the same thing. They've just expanded the "project" circle a bit.

A notable exception to this would be an "alpha group", where the "value" is information about which other unrelated projects to invest in. That is sustainable (as long as there are viable projects to invest in).

What cannot work though is, for example:

- We're going to do an airdrop and then you'll get your money back.

If that's the utility, you're being paid off by later investors. It's a Ponzi.

- We're going to do a "utility token" whose basic utility will be designed so that you can sell it for money. (e.g. the Bananas of Cyberkongz)

That's still money, just disguised as... a currency? Poor disguise imho. Ponzi again.

(Cyberkongz also provides alpha though)

- We're going to allow you to stake your tokens so you can make money from them. (A lot of projects doing that at the moment)

There's still only one possible source for that money: more investors. It's still a Ponzi.

- We'll pay you royalties/rewards from the sales of the tokens! (the #LazyLions model - but please note that the Lions also have other value being provided - more on that later)

Where's that money coming from? Still investors? Then it's still unsustainable.

Any time a project pitches "utility", sure, I would love it to end up being worth more than what I paid for it. But that's a fantasy. As long as I'm being paid in investor money, it's not sustainable, and never will be, and the project is ultimately going to be a dead end.

The only *sustainable* value is going to be the value that does not translate into money. At least not investor money. It has to come from somewhere else.

A number of projects have cracked this or are working on it. The NFT space is not just art and ponzi schemes.

Example: Cryptopunks: the value is being part of a certain community, having access to them, and the cachet of being associated to them. And hey, you might get to hang out with @punk6529, that's gotta be worth something.

Example: BAYC: similar value. And being associated with what is now a global brand. Some of that brand's coolness translates to you. And maybe you'll make money from that, but it's not coming from BAYC investors. Having an ape is inherently valuable rn.

Example: @NFTLlama community, and, from what I hear, @CyberKongz, at least the genesis ones. There is value in being part of a smart alpha group that shares and discusses insights.

Example: @LazyLionsNFT . The roarwards are actually a diversion, ultimately not real value. But it is clear to me LL are building a brand, and a powerful marketing machine. It's not all in place yet, but owning a lion is not about getting some cash payouts, to most lions.

Example: @pixelbeastsnft . I'm not in that community yet so can't confirm 100%, but my sense is they are building a community of web3 founders. There's value in being part of that group, and it's not in the form of "here's some cash from our latest round of investors".

I'm sure there are many more that I don't know about. But for every one of those there's 10 or even 100 who think that "utility", or "value", can be money that comes from later investors.

Beware of those. Don't invest in those unknowingly.

And if you're a project creator and you're thinking of launching some utility token to draw in more investors and boost the price of your NFT...

PAUSE.

Take a breath.

Think: do you really want to run a Ponzi scheme?

If not... start figuring out how to deliver real value to your investors, who are, basically, also your customers.

NFTs are a fantastic new model for pseudo-commercial entities. But it's easy to get it wrong and just create another unsustainable scam without intending to.

TL;DR: Any "utility" that translates to "money from other investors" is inherently unsustainable.

Don't make long term investments in unsustainable projects.

Good luck, and gm.

PS: I think I will analyse some popular projects from this perspective over the next few days, in more details.

PPS: If the word "Ponzi" really bothers you about your project that you're invested in, please feel free to substitute it with: "Project with serious sustainability concerns" :-P

Original Thread: