Is there a new NFT "bull" going on?

Are bull times back?

Spoiler: no.

But so where is all this market activity coming from? Prices ARE going up.

Wtf is going on?

Who is paying for all this?

How long will it last?

Ready for a trip down the rabbit hole?

Before going into the "why", let's have a quick glance at the "what". Yes, prices are up. And volumes have also been up.

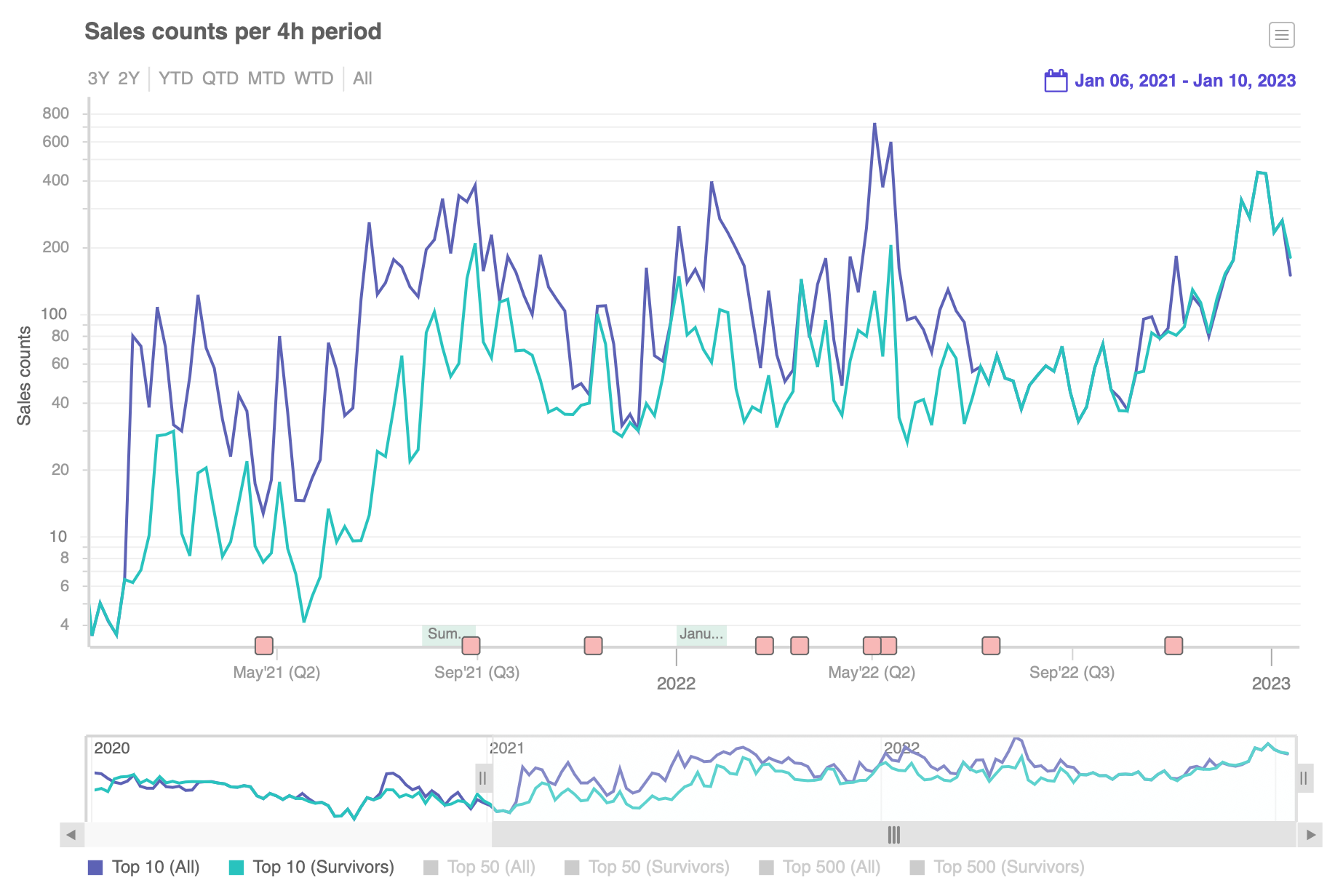

According to my charts, we can in fact see that the dynamic top10 volumes are back up to bull levels of activity. (though it may have peaked already)

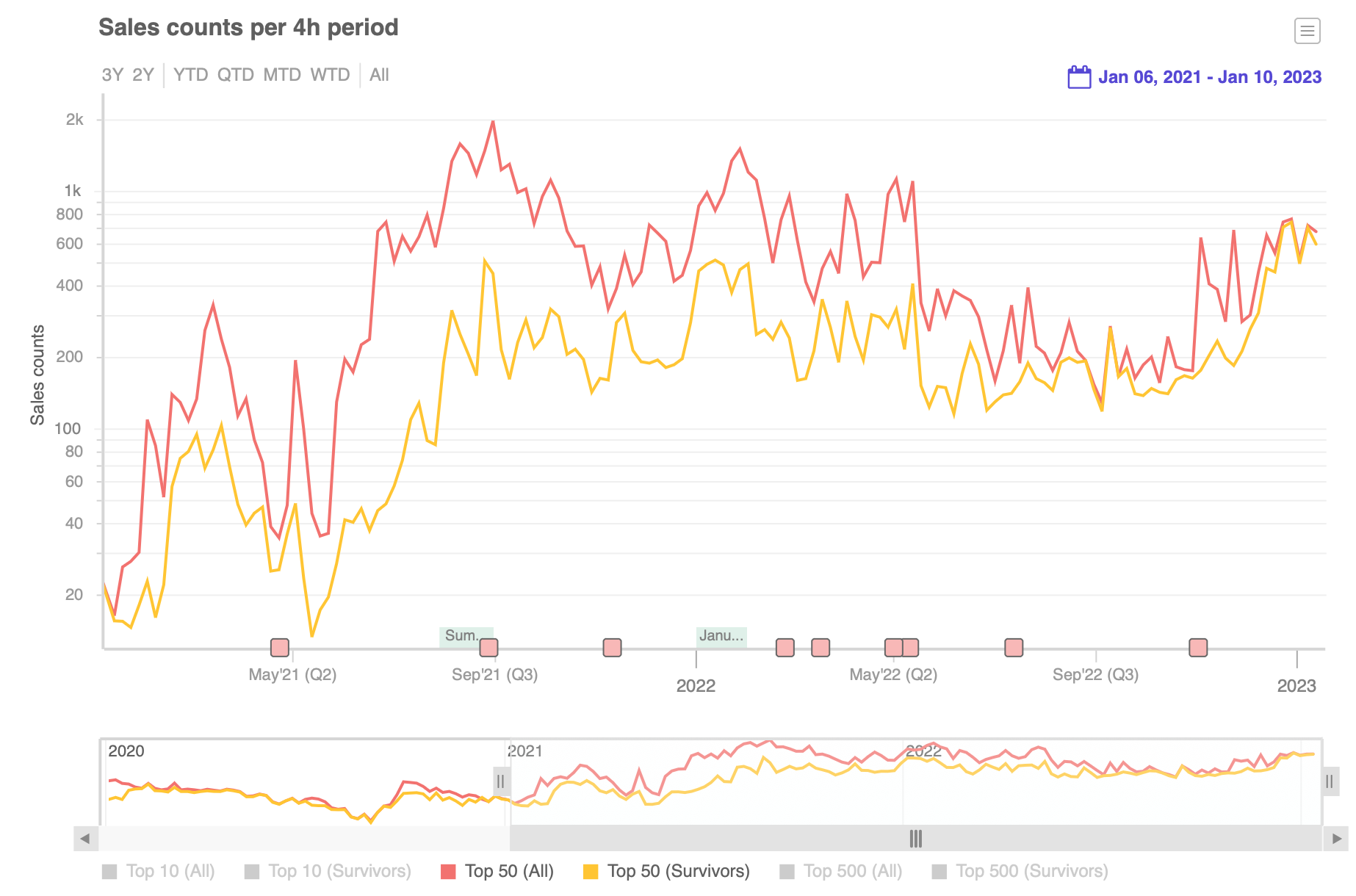

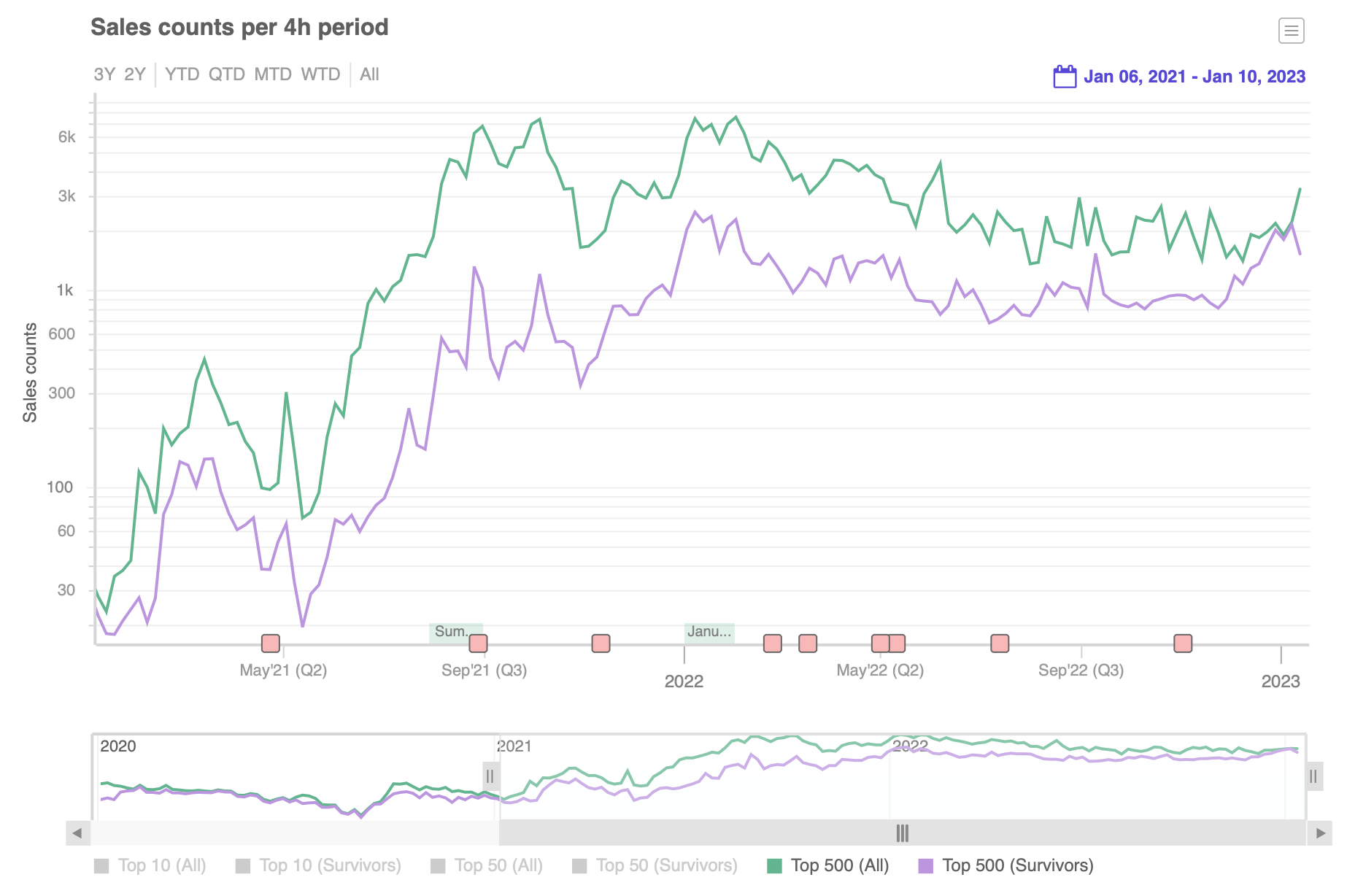

That's also true of the dynamic top50 (to a lesser degree) and top500 (even less noticeable there though).

(note: these charts are generated by my own engine, based on data from @reservoir0x - you may be able to access this on https://nft-markets.swombat.io if server is up).

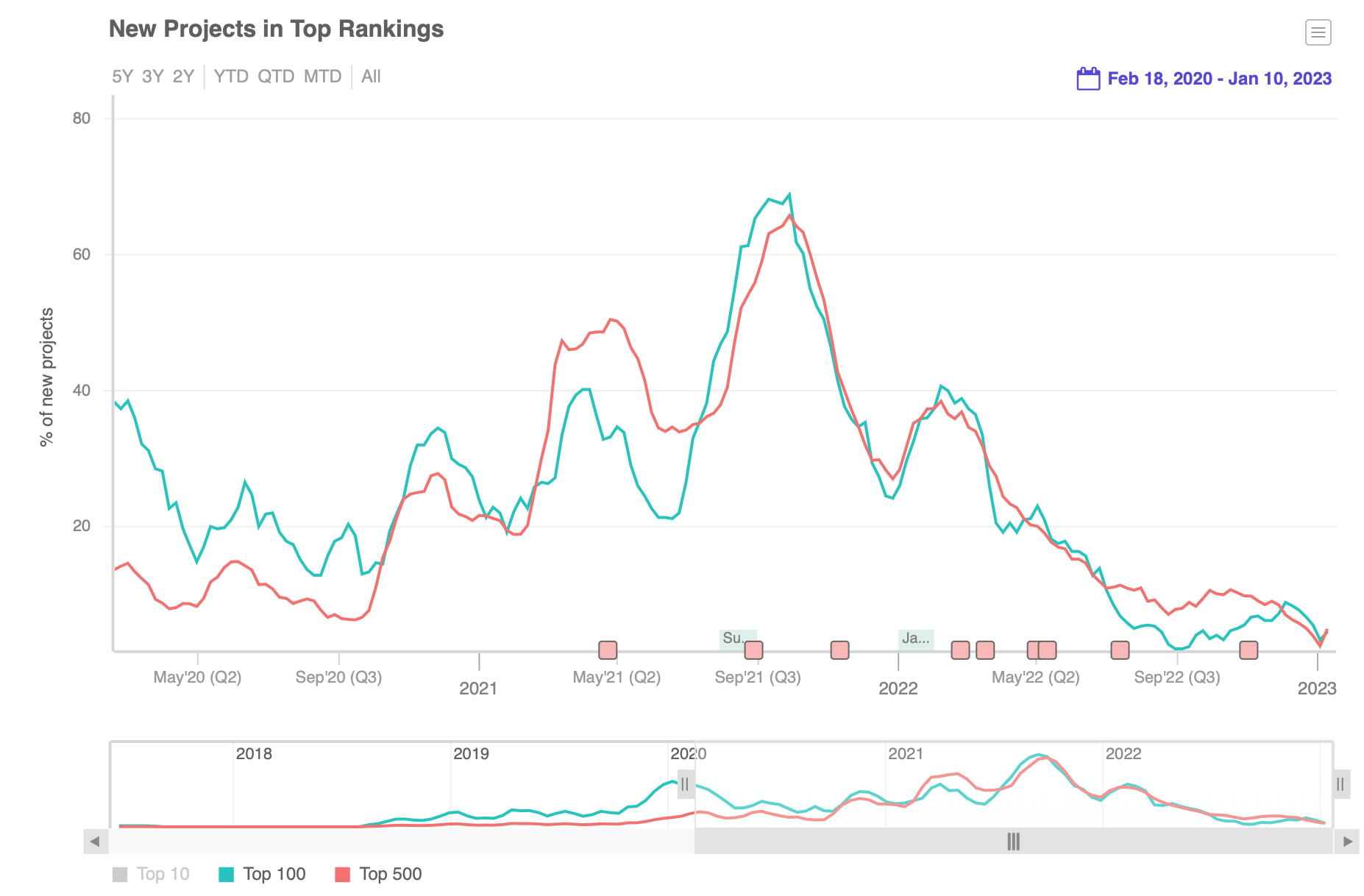

There's another report I created a while back which I find interesting in terms of finding out what kind of "bull" we're experiencing - it charts how many "new" projects break into the top 10/50/500 (according to my "relevance" algo).

This one is less comforting. You can see the last few bull markets very clearly on this chart... and it's not showing anything interesting right now. Whatever's going on, it's not really resulting in lots of new projects - just existing, established projects pumping.

So if it is a "bull", it does not follow the patterns from previous bulls. That much is clear. There are nowhere near as many new projects breaking out as there have been in previous bulls.

The data confirms that unambiguously.

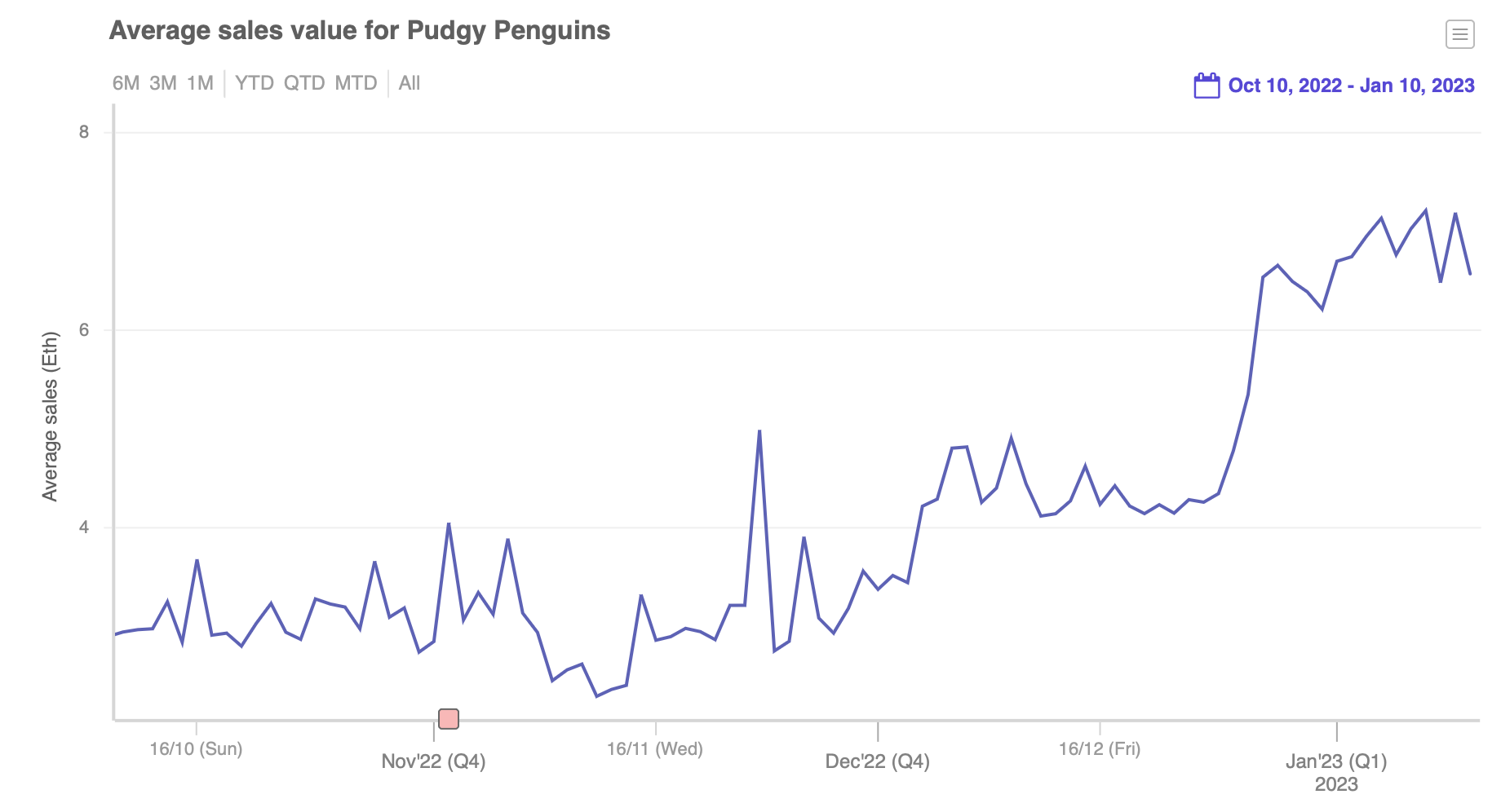

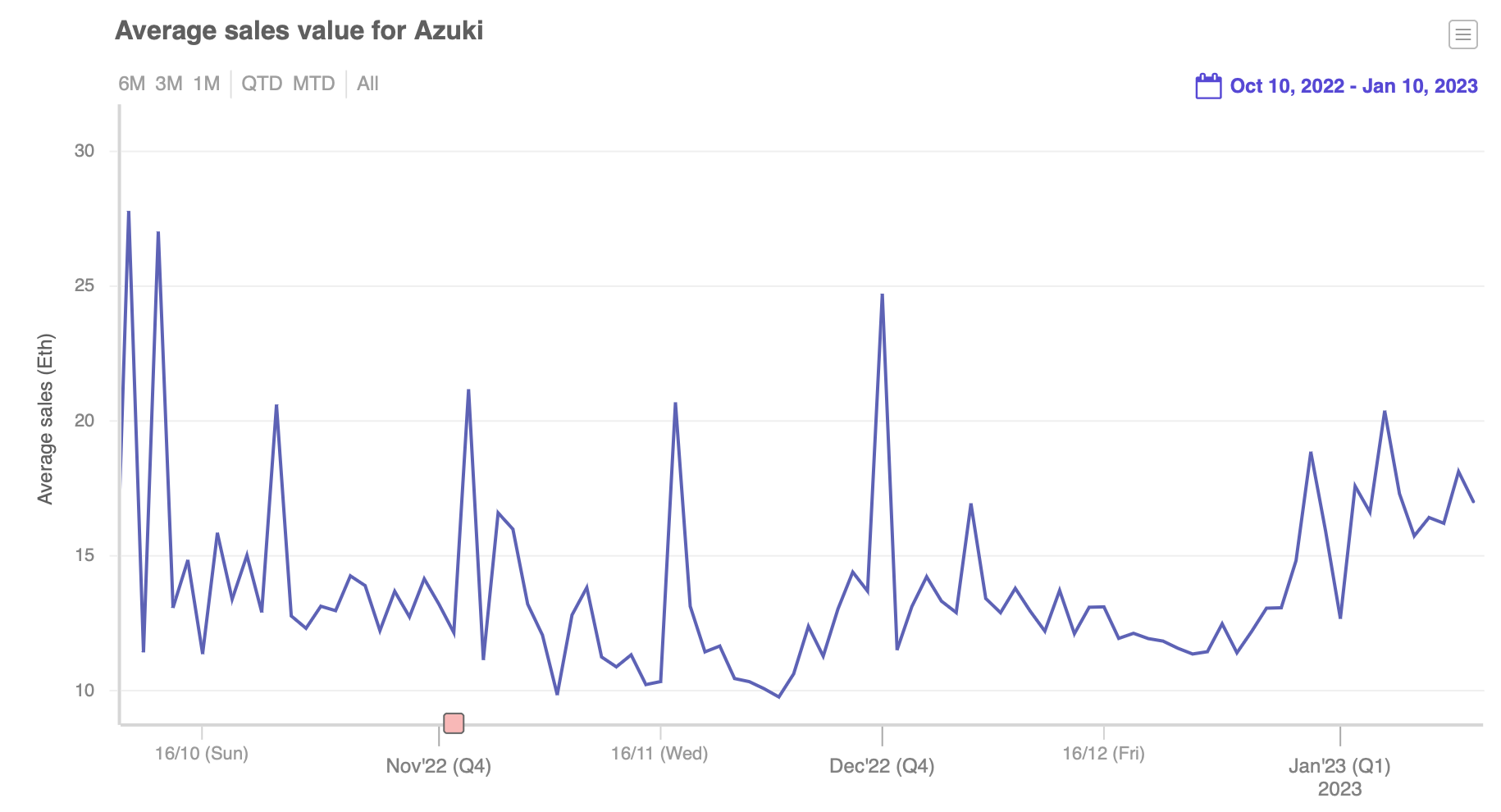

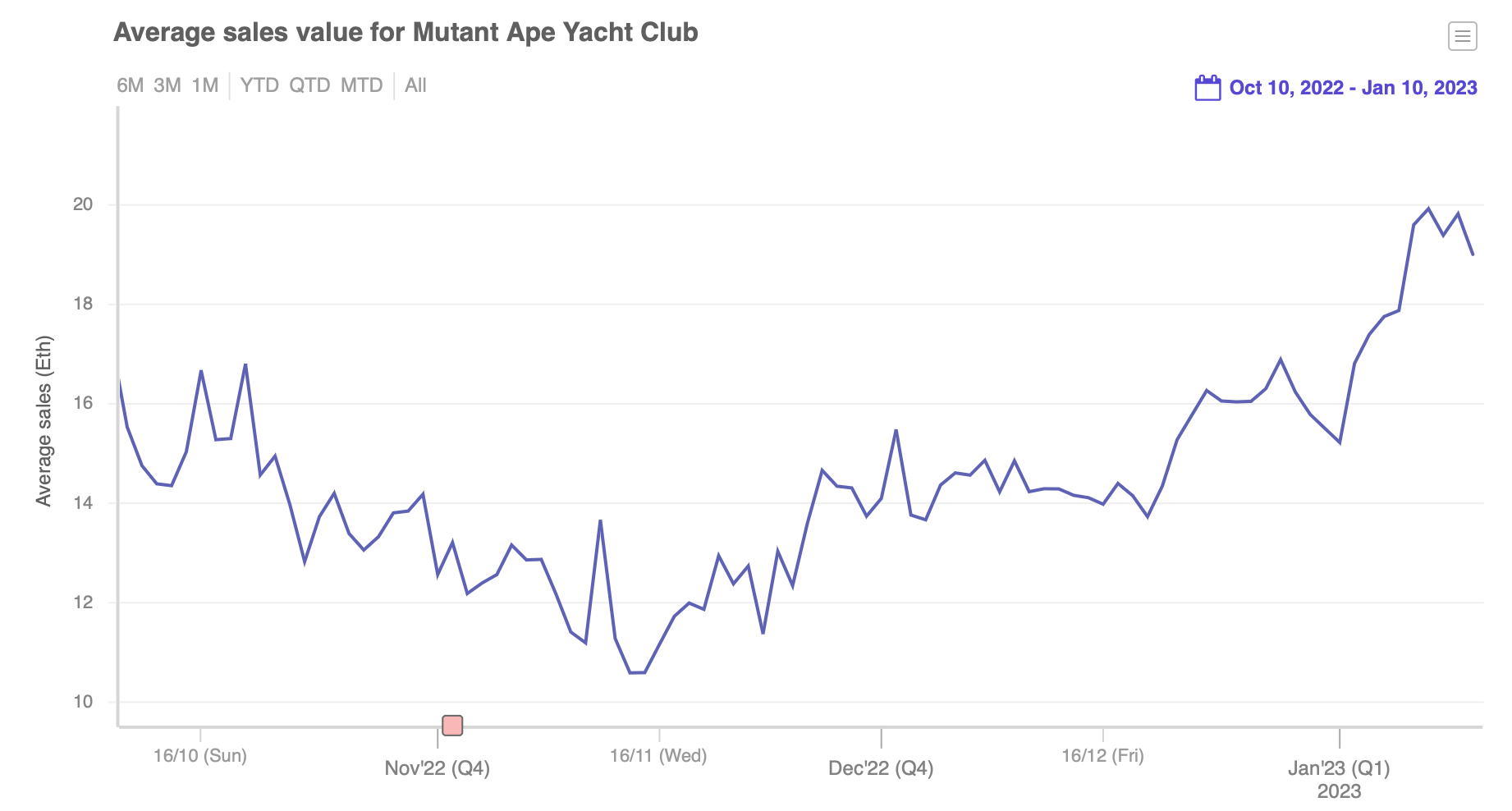

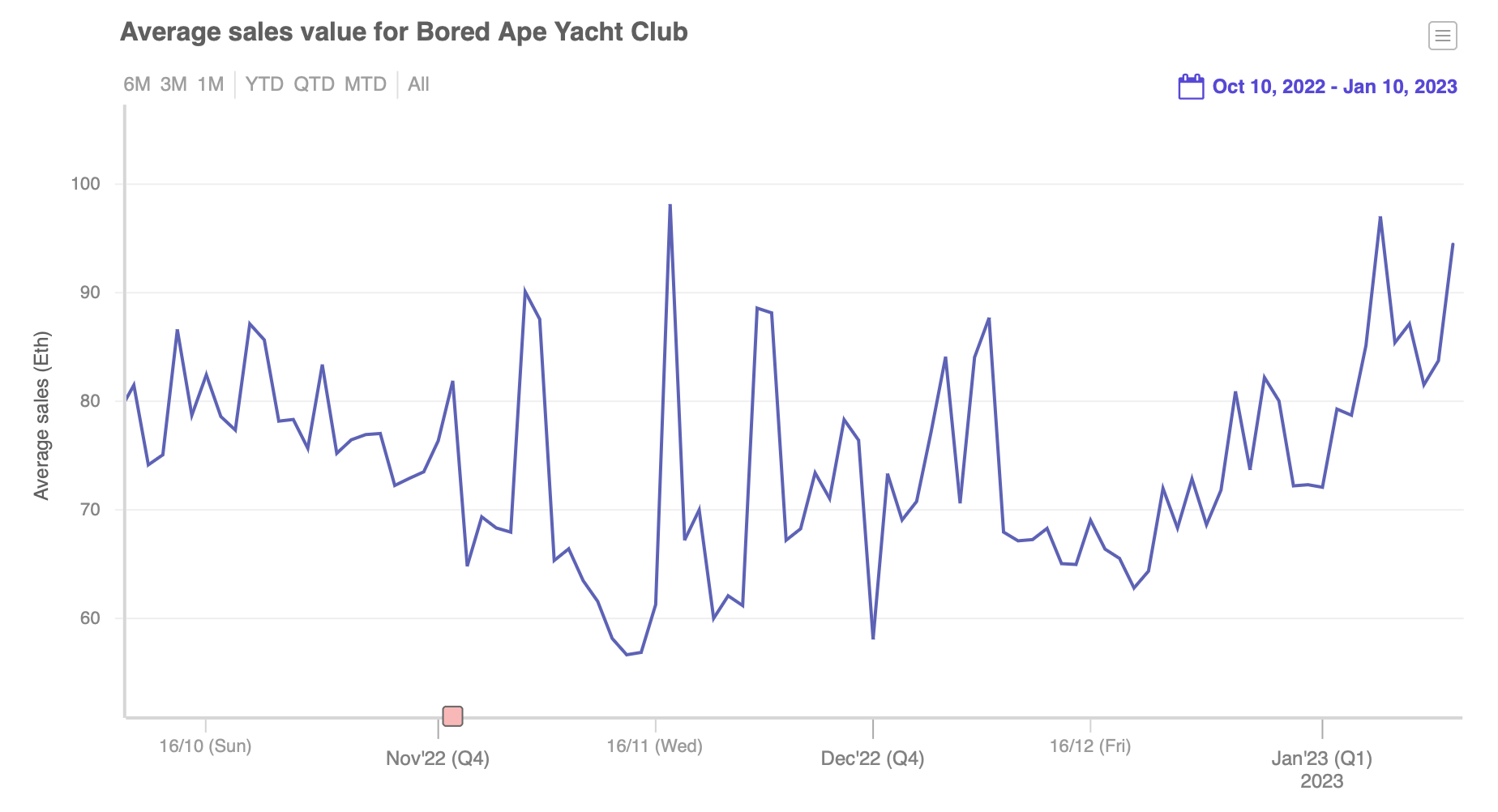

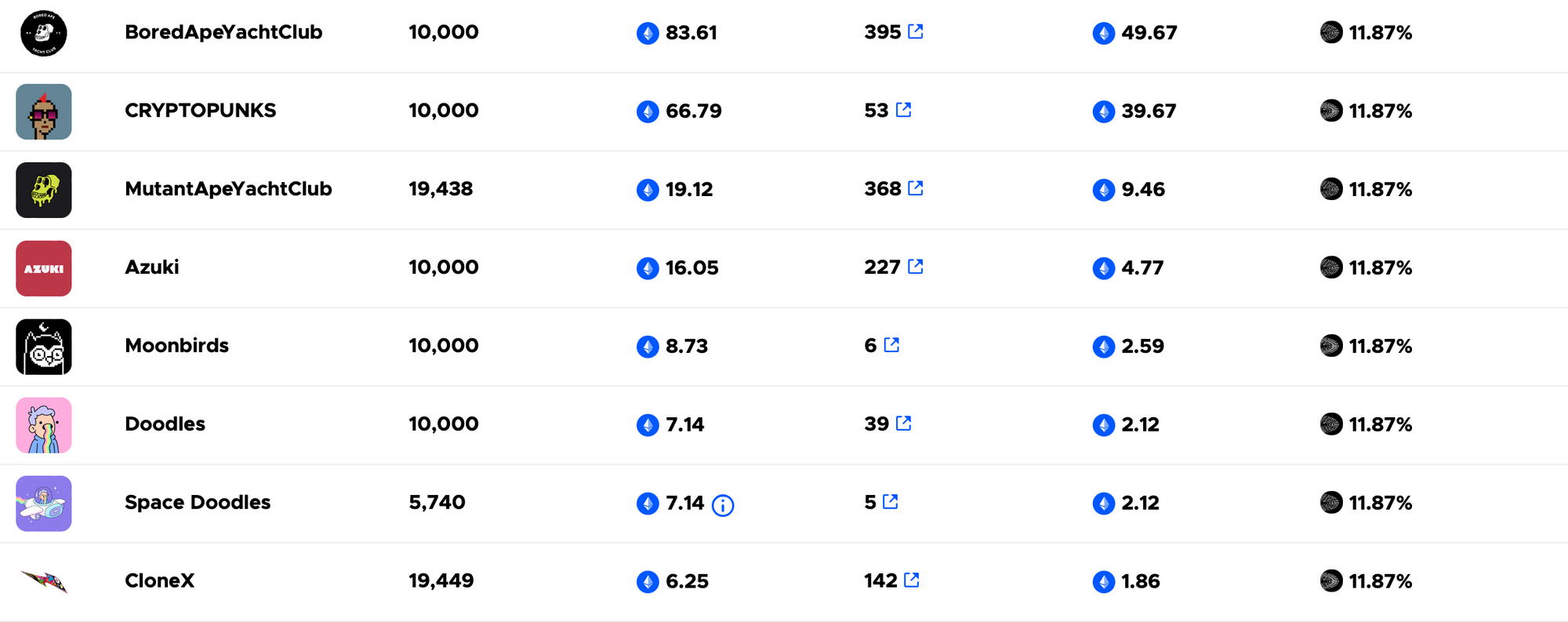

Yet we are seeing projects like BAYC, BAKC, Azuki (🤮), etc, pumping:

- WHAT

What is going on?

I've been bearish on this "bull" since it began, on the basis that these kinds of bull/bubble events are driven by large numbers of new ppl entering the market - a flood of new money. And there is no reason for this to happen right now.

Macro is 💀. The invasion of Ukraine rages on. Inflation is high. Rates are still going up. Economy is heading into recession.

Crypto is settling in for a crab market for at least all of 2023.

No major innovation driver for ppl start believing the NFT Ponzi fever dream rn.

So where's all the money coming from?

Well, I think there are three major sources, and I'll let you make up your mind about their su

stainability.

Let's go in order of how problematic they seem to me...

- The first source is probably Blur. Well, not really Blur... more like the EXPECTATION of Blur. As I pointed out in this humorous video, there's a bit of a circular logic thing going on with Blur:

So about that Blur volume and all those valuable $BLUR airdrops... pic.twitter.com/awAAYBquKJ

— Daniel Tenner (swombat.eth) (@swombat) December 11, 2022

But just because $Blur is not launched yet doesn't mean it can't impact the market. See, a lot of people are EXPECTING to make money from all their $Blur farming. So they feel rich. So they spend more. Which gets the market to feel a little better.

That then encourages others who are looking at the charts to dip their toe in. Which makes the market feel a little frothier again. Which works as a wonderful little cycle that pumps things up based on, well, nothing, really.

Because once again, as per my video, the only real driver of value for $BLUR is the transaction fees (which Blur isn't even charging yet), which will also come from the traders, who will stop trading as soon as they stop earning $BLUR for it.

Please draw this out on a whiteboard and make your own mind up as to how sustainable that seems.

And remember: if you can't figure out exactly who's paying for all this... it's you!

The problem with this particular dynamic, imho, in terms of its bull market driving potential, is that it's internal to the current NFT crowd, which, as I pointed out yesterday, isn't exactly big.

The NFT market as it currently is is really tiny.

Let's do some back-of-the-napkin numbers...

👇 pic.twitter.com/IWijl7f869

— Daniel Tenner (swombat.eth) (@swombat) January 9, 2023

- The second driver for this is... well... umm... how shall I put it politely.

Insanely risky and stupid.

Sorry, I couldn't come up with a nicer phrase.

@punk9059 pointed to this recently:

A🧵on lending & volatility:

The result is higher volatility in both directions

We have a bit of this in NFTs now

(1/6)

— NFTstatistics.eth (@punk9059) January 6, 2023

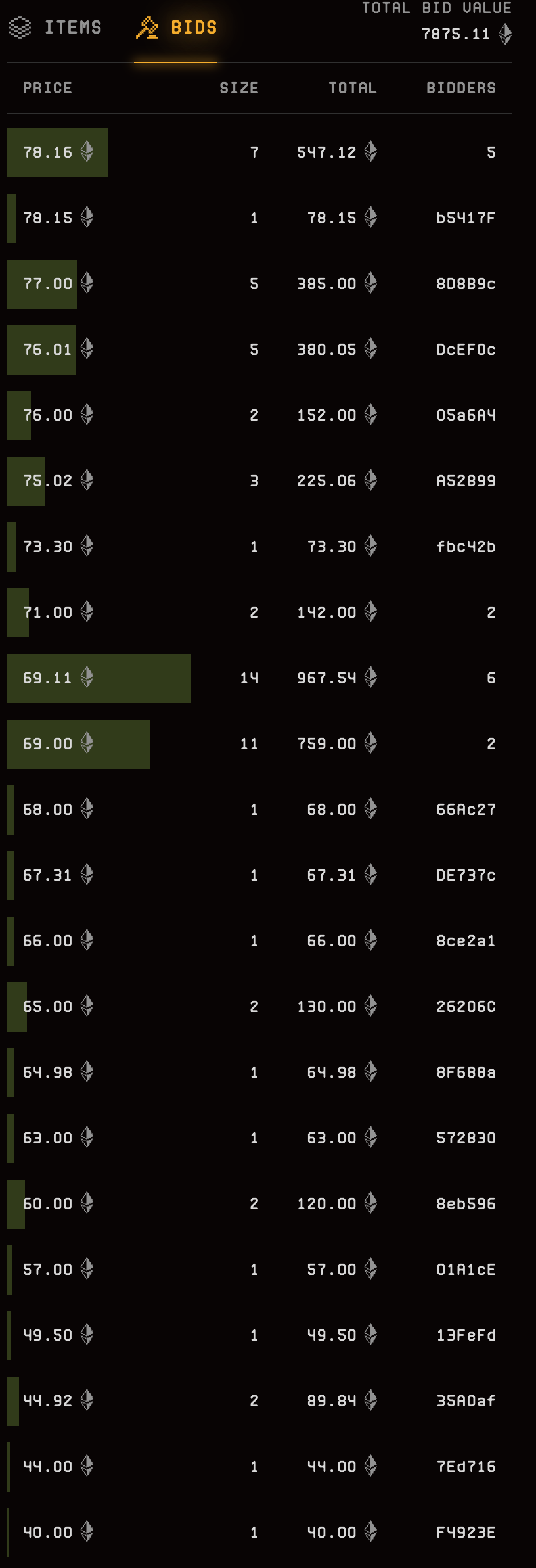

There's a lot of lending of NFTs going on via BendDAO.

Most of it is on BAYC and MAYC. 395 Apes are out on loan rn.

This is potentially a big problem, because even with Blur rewards getting people to endlessly farm rewards via collection-wide offers, the order book for BAYC is thinner than a dictator's skin.

A lot of those apes start going into liquidation if the price dips to just over 60 Eth... which is only 20 Eth below where we are now.

Which would then drive the price of Apes down further.

Causing more liquidations.

Liquidation cascade anyone?

If you've been around for the last year and observed what happened to crypto markets, you can recognise an old friend at work here:

LEVERAGE.

Ah yes, that's what we needed in our NFTs - additional leverage. Well, we sure got it.

Completely agree. The thing to learn from the last cycle is that people weren't using enough leverage.

— carlini8.pcc.eth 🧶 (@Carlini8NFT) January 9, 2023

And with this, I think we also have a good idea of where much of this market activity is coming from - liquidity from massive loans taken out by ppl leveraging their apes.

But there's one more thing!

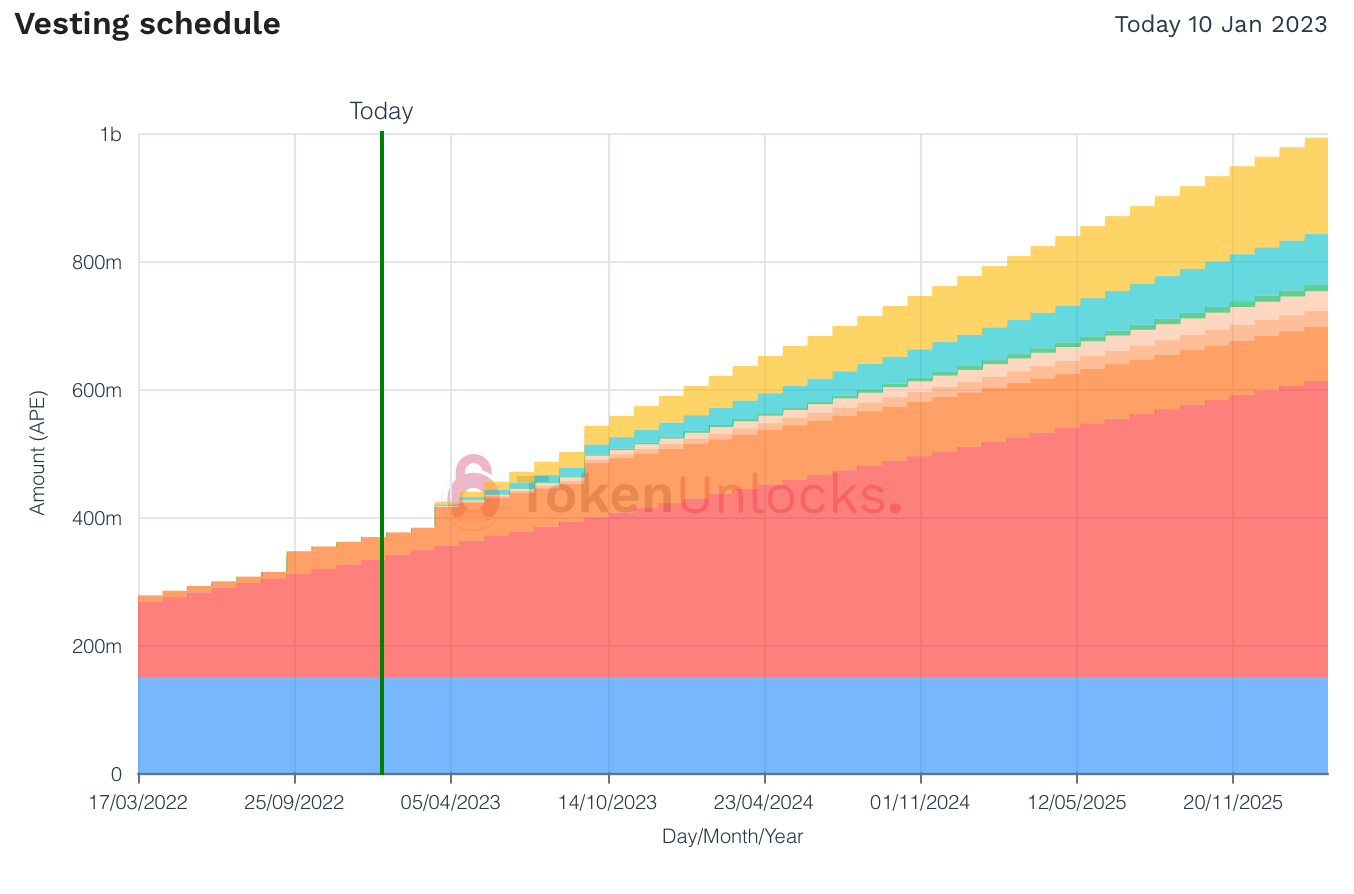

3. $Apecoin staking.

Rightly criticised by @cobie back when it was announced/proposed, Apecoin staking is, put plainly, just good old, utterly empty and self-serving ponzinomics.

https://twitter.com/cobie/status/1517086096173469697

This is another source of ppl feeling wealthy, and gives them another place to stick their money to get returns. Also connected to those Apes on BendDAO, I'll add.

It creates another "trading" opportunity that makes ppl feel wealthy & increases their risk appetite.

Of course, Apecoin has zero utility, other than something to do with "the trial of jimmy the monkey". Its only utility is ponzi - sell it to someone else before it starts going back down again.

With all the staking sucking up supply, of course Apecoin is doing fairly well!

This is likely working as intended, propping up the floor of Apecoin as the unlock schedule inexorably multiplies the Apecoin supply, enabling Yuga backers (who I believe voted for this!...) to make a big, big pile of money...

Somehow this staking has been made so damn lucrative that about $65k staked can produce $1.5k of rewards in 4 days. That's more than 200% APR.

Sustainable? You tell me.

People don’t know that they can literally never work again if it’s me looking at things genuinely I would get a 10-20k loan buy ape stake on bendao, pay the loan and never work again esp buying ape at this price it’s a bargain

— Shahroon.eth (@shahroonk1) January 9, 2023

So... a nice trifecta appears to be driving this "bull" market:

- Blur rewards

- Leverage on BendDAO

- Apecoin staking

All of this seems particularly focused on Yuga/BAYC, which seems to be, as always, the main driver of activity in the "nft markets".

So what happens next?

Well, there's two things that are likely to happen next.

First of all, Blur will eventually make their rewards actually tradeable. At that point, I expect the sell pressure on $BLUR to make Blur farmers suddenly feel somewhat less rich.

Another likely side effect is a lot of the order book of Weth offers on Blur will vanish as soon as the economics for it are no longer just a fantasy in the future.

This will probably create some downwards pressure...

Another thing that's happening soon is the whole "trial of jimmy the monkey" whatever that Yuga Labs is cooking up.

As usual, it doesn't involve any actual product, just another mildly entertaining "experience" that will involves ppl spending $Apecoin in some way.

That is, by the way, one of the reasons I hear why ppl are stacking and staking Apecoins. They do so fully expecting the price to go down rapidly once the devs actually do something, and just hope that they'll be smart enough sell ahead of the crash.

One thing that I noted back when I was looking at charts every day is that every time Yuga Labs releases something major, it marks a local market top. Everything goes down for a while after that.

It was true for MAYC (peak of Summer 2021 bull), Apecoin (killed a mini-recovery), and Otherside (marked the final hurrah before the long summer of death last year).

It's not far fetched to expect the same thing to happen again, once whatever Yuga's doing is done.

Except this time, we have leverage! Lots of it!

With 400 BAYC apes already on loan on BendDAO, and, probably, all that money locked up in other illiquid projects and in self-reflective Apecoin, oh boy... this could be a fun ride.

Of course, it's important to clarify that I have no idea what will happen. I'm just a dude looking at the NFT market. Someone drew my attention to this... interesting situation, and I'd already been asking myself where this volume was coming from... so here I am writing a thread.

If your reaction to this is "wow, I want to short this stupid shit right now!", then I'm told https://nftperp.xyz will enable you to do just that.

Just remember that the market can stay irrational a lot longer than you can stay solvent. And I could be totally wrong.

I'm not invested in either outcome. As I have shared many times, I'm a bit tired of the endless ponzinomics in NFTs, but I'm certainly not wishing for ppl to lose their shirts.

Quite the opposite. Maybe some ppl will be more cautious with the above info.

So... umm... yeah...

Be careful out there, folks.

And if you'd rather forget about all the ponzis and look at the enormous potential of NFTs as a fundraising method for genuine startups, come join me on Discord!

Original Thread:

https://twitter.com/swombat/status/1612818724163026944