NFT "Bull" update, part 2

I'm still concerned about what happens next with "the NFT market".

BAYC FP is at 69 now. It only needs to drop a bit more for apes to start getting liquidated.

And the rest of the market is... not great, to anyone who was here this time last year.

Are bull times back?

But so where is all this market activity coming from? Prices ARE going up.

Wtf is going on?

Who is paying for all this?

How long will it last?

Ready for a trip down the rabbit hole?

👇 pic.twitter.com/f8Vnym8gYc

— Daniel Tenner (swombat.eth) (@swombat) January 10, 2023

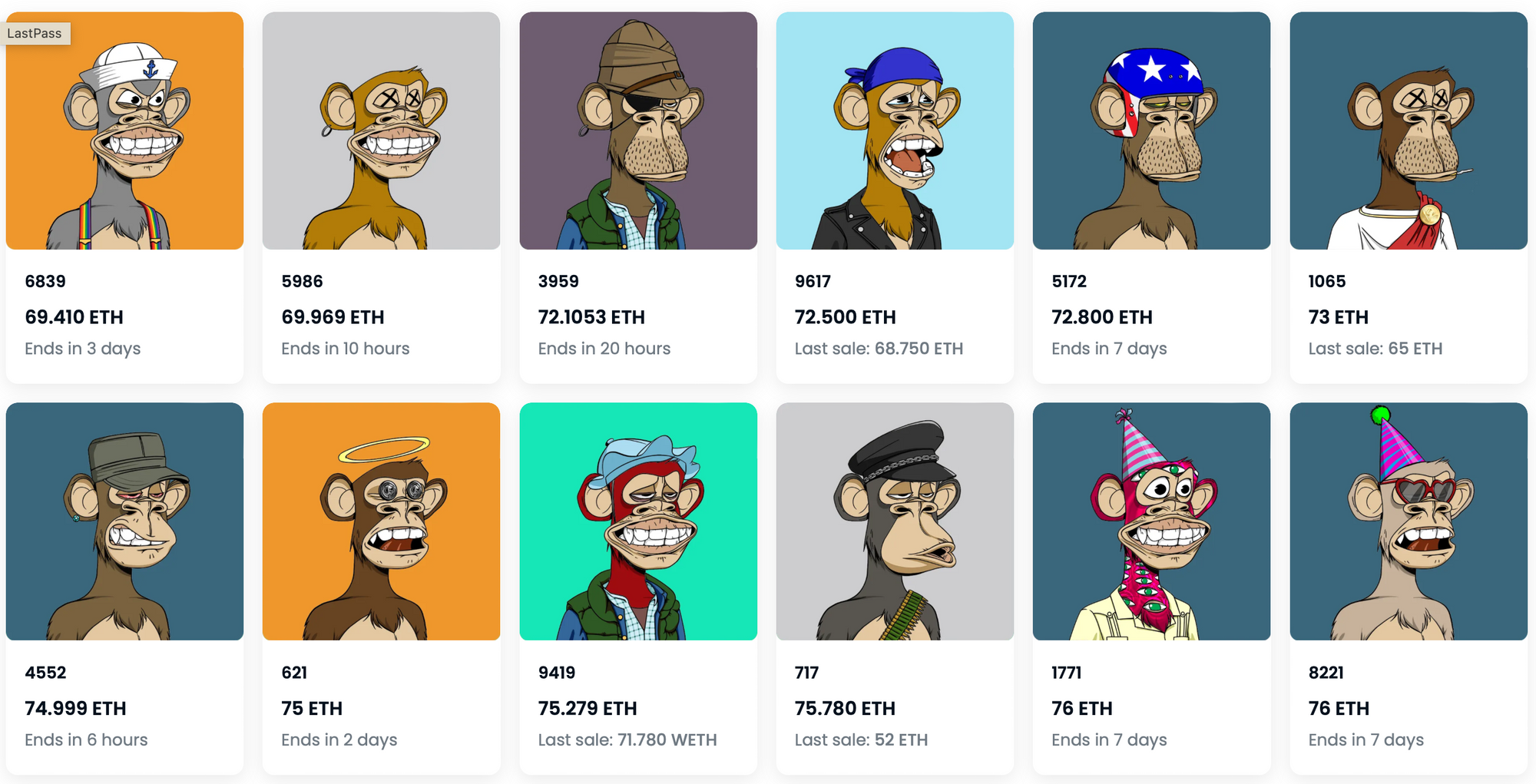

So let's start with BAYC. Yes, the floor is "thin". The lowest is 69.410, with the next few 69.969, 72.1053, 72.5, 72.8, 73...

So it can go back up... somewhat quickly... a little bit...

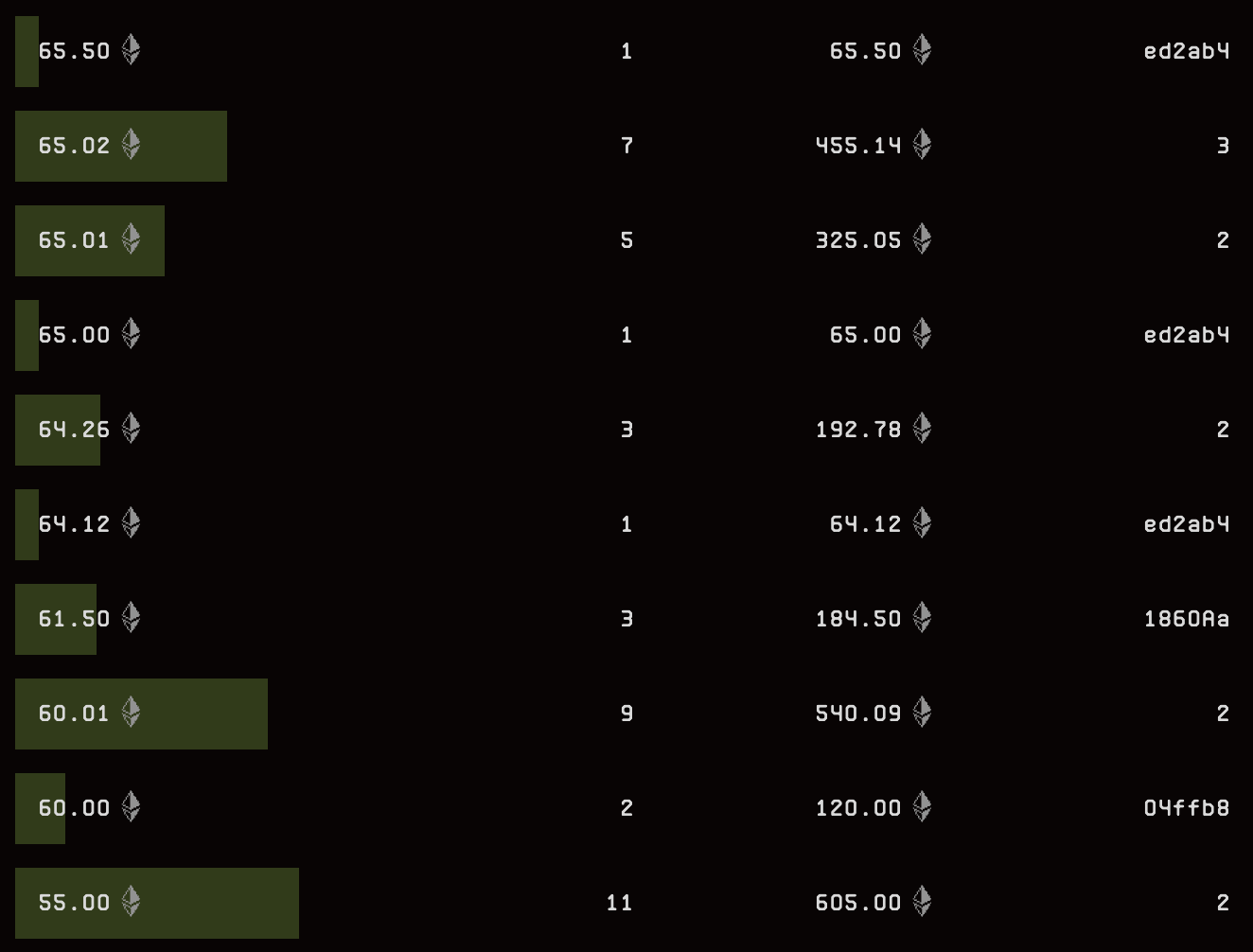

But then, the order book on Blur is also pretty thin. Only 18 sales and we're at 61.50... At that point, afaik, a lot of the BendDao book is getting liquidated.

How big's that BendDao book?

Umm... big. There's still 365 apes in there. If you look at the "health factor alert" screen it's almost all apes in there.

It'd take about 2 weeks at current bullish volumes to absorb 365 BAYC sales.

How does liquidation work? Here's the formula for health factor:

Health Factor = (Floor Price * Liquidation Threshold) / Debt with Interests

If HF goes below 1, the 24h liquidation protection window is triggered. If the loan is not paid in 24h, the ape is sold.

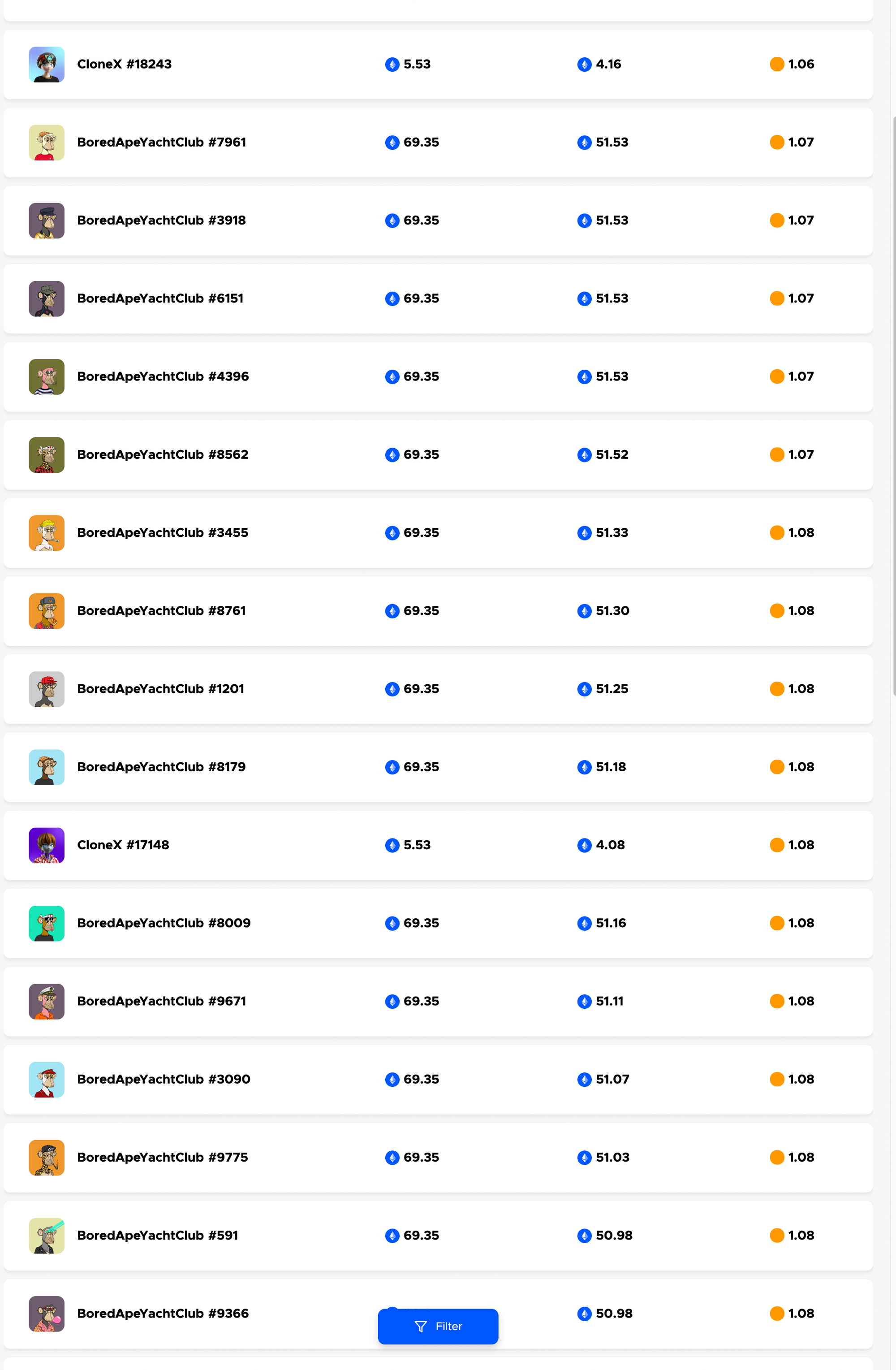

Using the numbers on BendDAO rn for the first ape:

1.07 = 69.35 * 0.8 / X

So debt with interest for that ape is 51.85.

So when is the threshold 1? when:

1 = FP * 0.8 / 51.85

So it'll be below 1 when the FP goes below 51.85/0.8 = 64.8

So if the floor drops by another 6 Eth, liquidation windows start opening.

I think the risk of a liquidation cascade is still pretty high, though it'll be slowed down by the 24h windows. That could end up getting the BendDao lenders rekt tho, mind you... FP might drop faster.

All of this is not too much of a problem if the market is healthy... but the factors I mentioned before are still at play, and worse, even - the Jimmy mint thing has been happening this week, and maybe is part of the reason why prices are going down.

Also, we all know crypto has been pumping, which is usually bad news for NFT prices in Eth. It has stalled for the last few days, but it could easily pump some more. Or crash - which also usually leads to NFT price volatility.

Damned if you do...

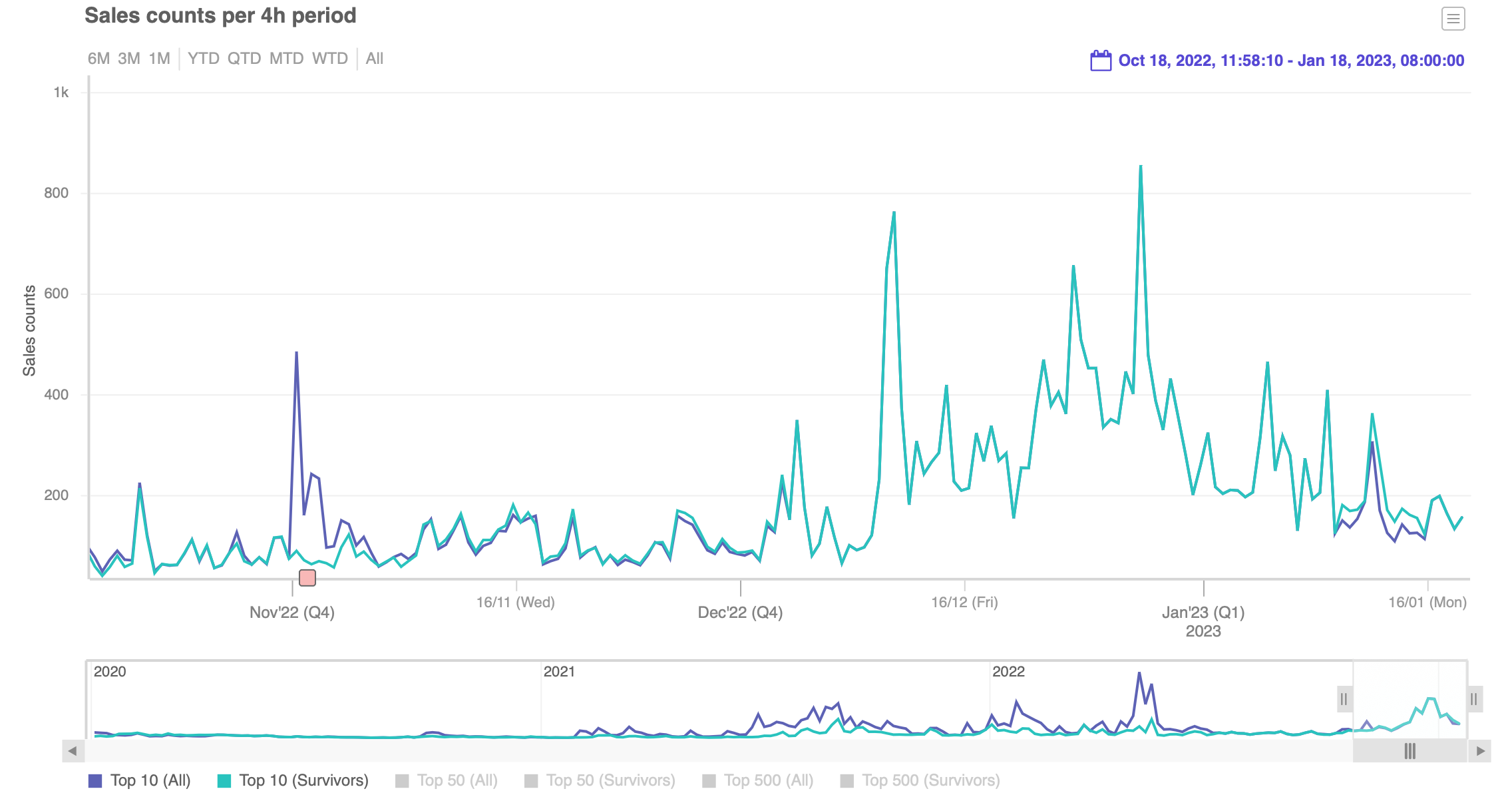

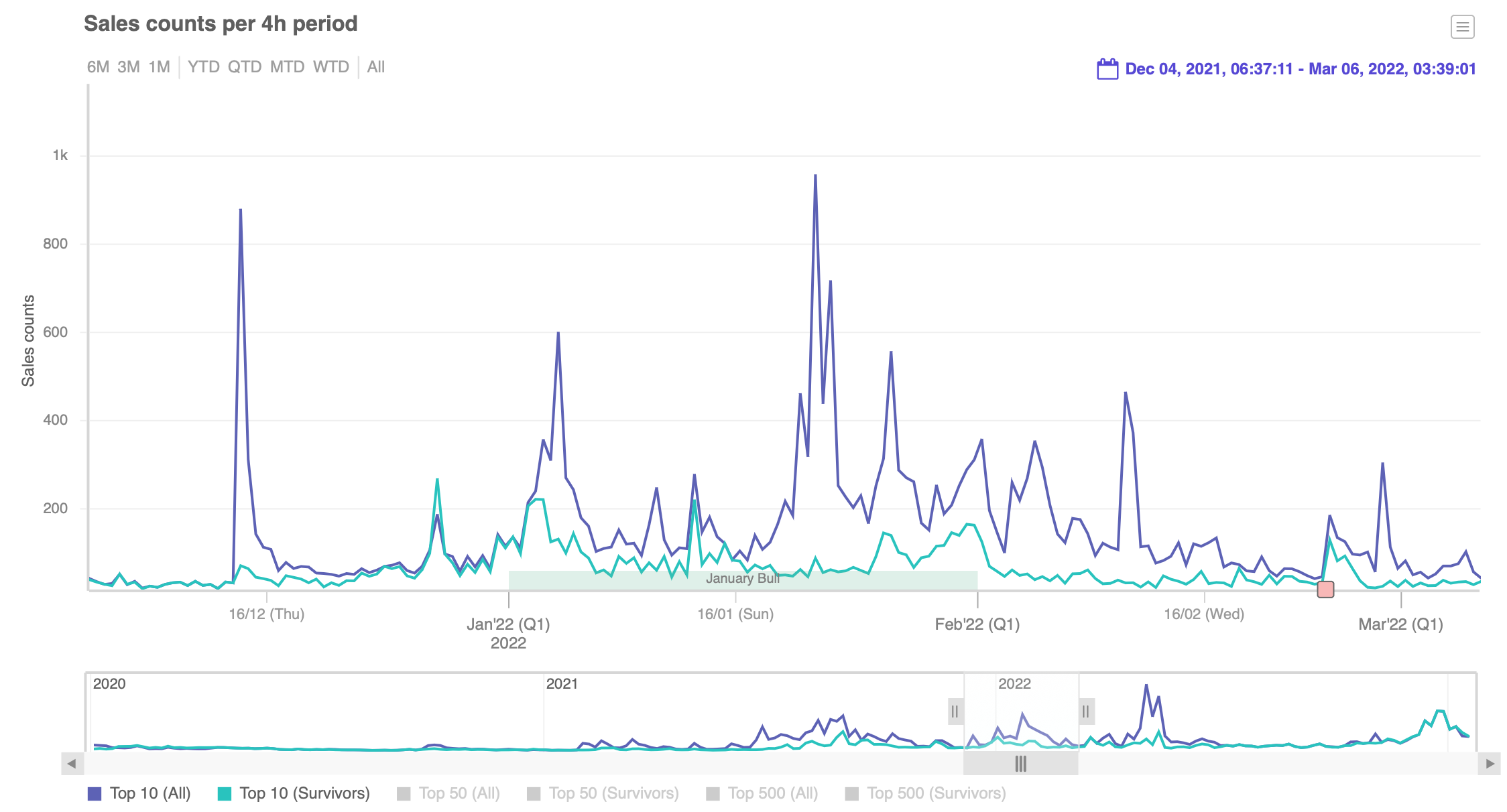

Looking at my volume charts also does not inspire confidence. See, this is the top 10 volumes chart... it looks like there was a little bull, and then now it's gone down. Sort of like what happened last year (2nd chart) but... less, and with fewer new projects.

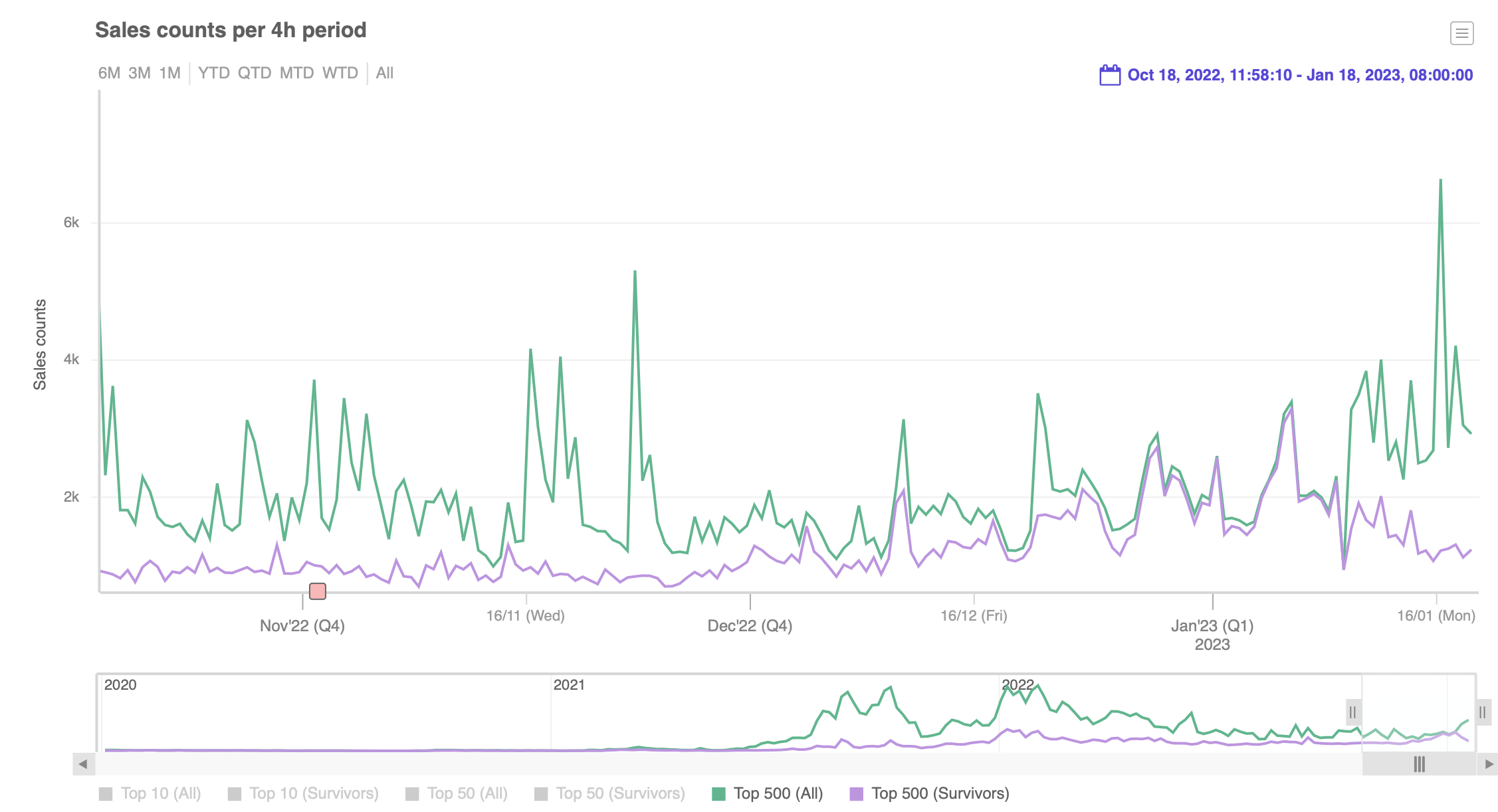

There are some volumes that are up though - the top 500 including new projects is trading quite actively. We've seen projects like feet pix and other nonsense getting attention.

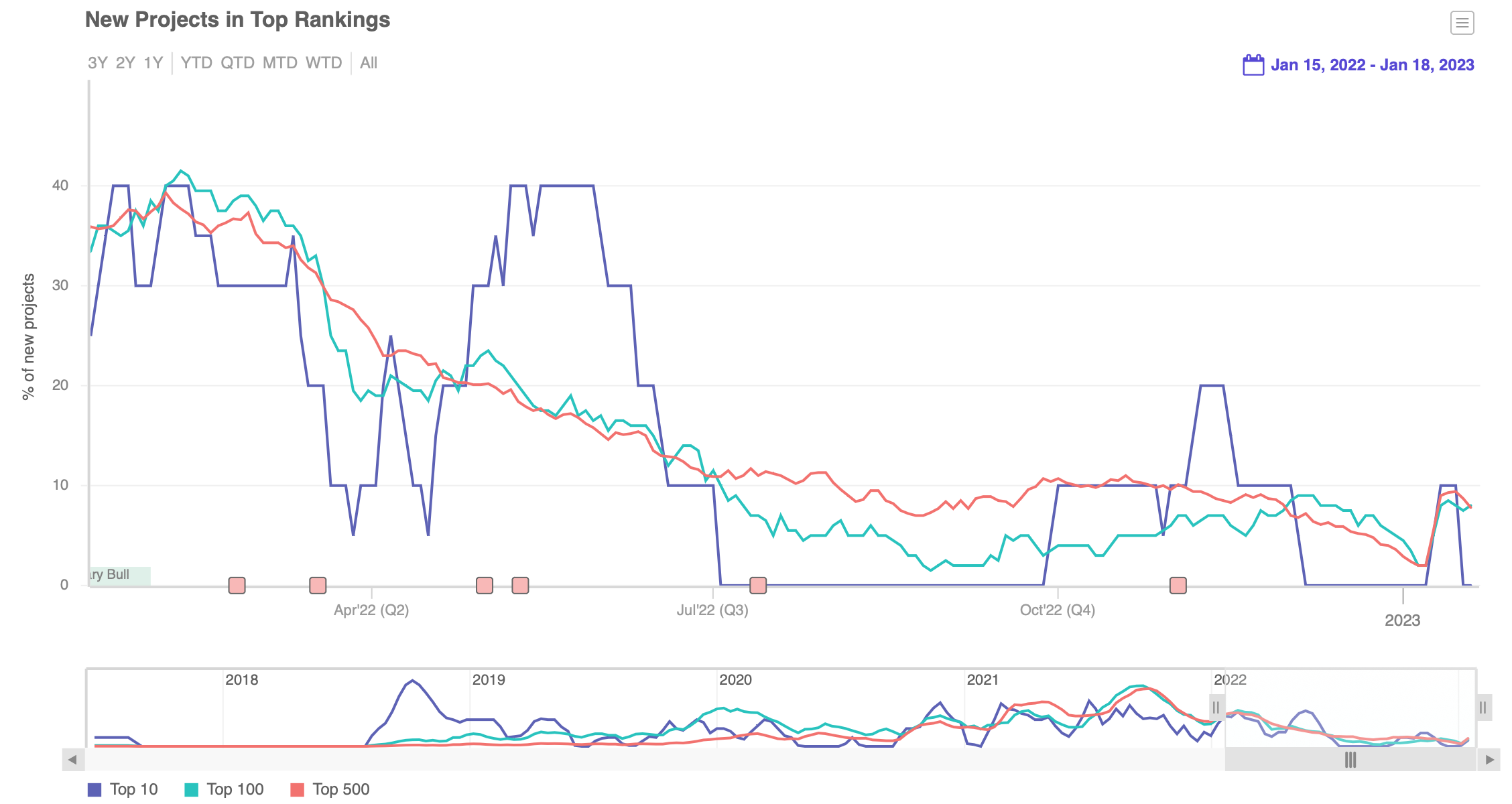

Meanwhile, the "number of projects in top 10/100/500, which is anyway a lagging indicator of bulls, is already dipping back down after a fairly unimpressive bump.

A bull market followed by meme projects trending... where have I seen this before?

Oh yes, of course, in Jan/Feb last year, before the long bear started (minus the last gasp when OtherSide minted and finally kicked everyone in the teeth).

And meanwhile, the Blur rewards are still on their way, and could also cause a deflation once they are actually tradeable.

So, to summarise:

- BAYC could enter liquidation cascade if price dips

- Eth could cause price to dip if it does... anything

- Blur rewards & Jimmy could cause more dips

- Market volumes look like maybe we're in the late bull "shitcoin projects" phase already

Fun times.

As ever - I am not invested in this, and I am just some dude on the internet. I could be wrong about all this. I don't think I'd feel reassured if I had a lot of exposure to this rn though.

gm and gl

Original Thread:

https://twitter.com/swombat/status/1615672264942358529